Catch up on latest developments with the Council’s next 20-year power plan for the Pacific Northwest

Council aims to release a draft of the Ninth Power Plan for public review and comment by mid-2026

- November 25, 2025

- Peter Jensen

2025 has been a busy year for the Council and the Power Division staff as they develop a new 20-year plan for the Pacific Northwest’s electricity grid, which is called the Ninth Power Plan. With the end of the year fast approaching – and some critical analytical milestones and decision-making points looming early in 2026 – here is a recap of the Council’s work on the Ninth Plan so far, and a timeline for what’s going to happen next.

Our goal is to release a draft of the Ninth Plan to the public by mid-2026 and adopt it by November of that year. The Ninth Plan comes at a critical point with the region facing significant load growth and a shifting resource mix. This plan will put forward robust recommendations for how to cost-effectively meet those needs over the next twenty years.

Under the Northwest Power Act of 1980, the Pacific Northwest’s approach to power grid planning is different from just about everywhere else in the U.S. It is a regionally coordinated, public process where everyone – utilities, groups, and individual citizens – can help decide how we meet our growing and evolving energy needs. We invite and encourage public participation throughout the region as we continue to develop the Ninth Plan in 2025-26.

About the Council’s regional power system planning

The Council represents the states of Oregon, Idaho, Washington, and Montana in developing a 20-year power plan, which is reviewed and revised every five years. Key components are a 20-year load forecast, as well as a cost-effective strategy that identifies resources to add to the electricity grid to meet those future energy needs. The Power Plan aims to ensure the resource strategy meets the Council’s adequacy metrics and thresholds, which protect the Northwest power supply’s adequacy at peak demand periods.

Planning under uncertainty

Congress passed the Northwest Power Act with a specific mission to plan under uncertainty. Creating a plan that addresses the energy needs 20 years into the future in a region as broad and diverse as the Pacific Northwest requires an intricate and deeply analytical multi-year process.

Uncertainty is a fact of life in power grid planning. That’s why Power Division staff uses a forecast range for load growth covering low, medium, and high trajectories. We also test different fuel prices, water years, wind profiles, solar profiles, and temperatures. We use scenario modeling to test more uncertainties, like the pace of expansion of the regional transmission system or the cost of resources.

By working collaboratively with utilities, Bonneville Power Administration, and many other regional partners over the past several decades, we’ve achieved a remarkable success story in regional power system planning in the Pacific Northwest. Our regional power costs have been among the lowest in the nation, while power supply shortages have been extremely rare. We’re proud of this track record, and we’re excited to work with the region to build on this legacy in our Ninth Plan.

What’s coming up next?

Our goal is to wrap up scenario analysis in early 2026. During the Council’s February, March, April, and May meetings, we will be discussing the results of the modeling and working to develop recommendations to include in the draft Ninth Power Plan. The goal is to release the draft Power Plan in July for public comment.

The Council will host a series of public hearings on the Ninth Plan in each of our four states in 2026, in addition to our monthly meetings. Stay tuned for upcoming announcements on meeting dates and locations in the Pacific Northwest in 2026.

Key progress to date

The Council adopted its most recent power plan in February 2022. We officially kicked off work on the Ninth Plan in February 2025. In between this time, the Council tracked regional progress towards 2021 Power Plan recommendations and started to prepare for the upcoming plan. This included:

- Developing a mid-term assessment of the 2021 Power Plan, which included tracking regional resource additions, energy efficiency, demand response, and new load growth, to provide continued guidance to the region between power plans

- Worked collaboratively to update the Council’s adequacy standard for the Northwest grid to an innovative, multi-metric approach

- Upgraded our computer modeling for load forecasting and regional resource optimization

- Released an issue paper to solicit public feedback on topics to be considered during the development of the Ninth Power Plan

- Started to prepare data and assumptions for load forecasting and new resource options to inform the Ninth Power Plan analysis

- Consulted with regional partners through our advisory committees.

Load growth

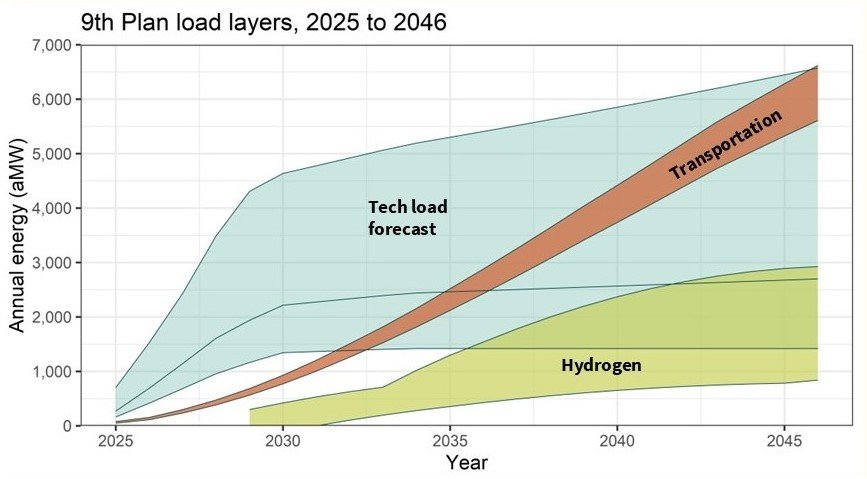

For the Ninth Plan, the Council published results of its new 20-year load forecast in April. We used our new computer modeling capabilities to get a deep understanding of future energy needs that gets down to hourly, daily, monthly, and annual levels of demand from 2027-2046. This helps the Council better assess impacts on peak, including for future summer heatwaves and winter storms.

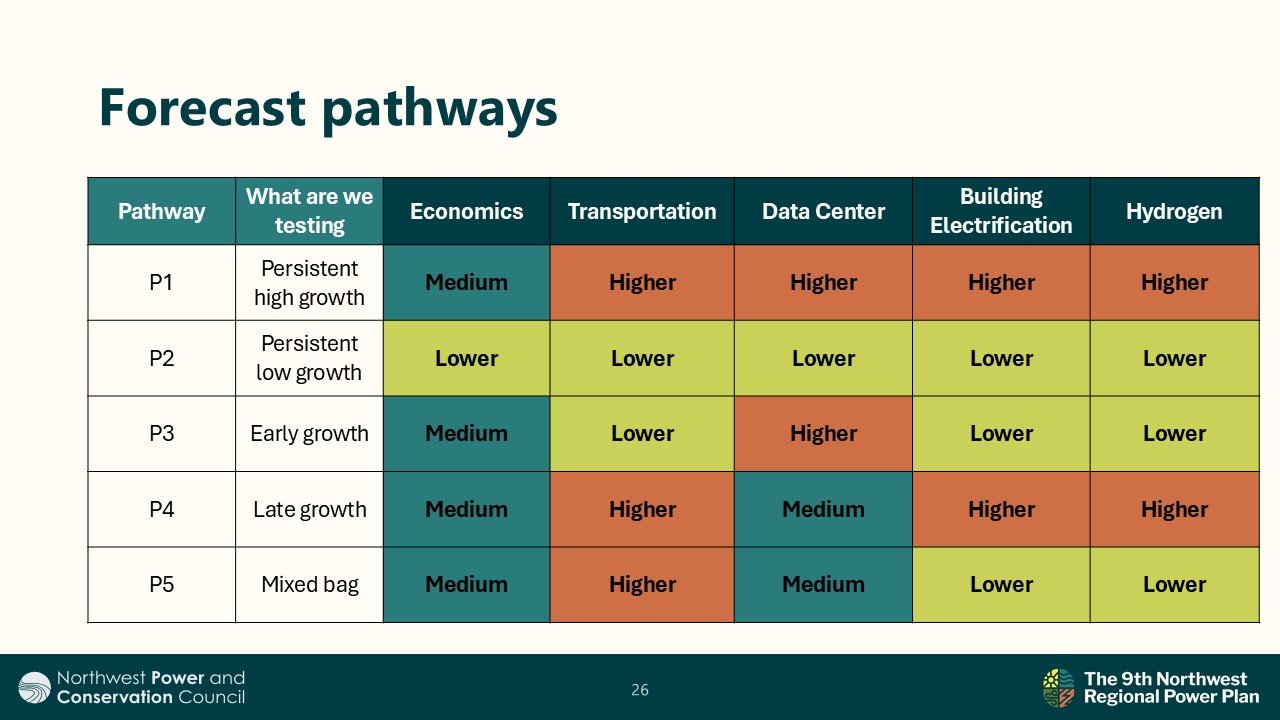

Council staff created five different load growth pathways across three different climate futures (15 total). This helps account for future uncertainty in economic conditions, the pace of electrification of buildings and transportation, and data center development in the Pacific Northwest.

The Council can also now break out energy demand and our resource planning by zones and locations in the Northwest, to better differentiate between the future energy needs of urban areas and those of rural communities, and the resource solutions that will fit those needs.

| Current levels | Low end by 2046 | High end by 2046 | |

| Annual energy | 22,000 aMW | 31,000 aMW | 44,000 aMW |

| Peak demand | 35,500 MW (winter) 33,300 MW (summer) | 47,000 MW | 60,000 MW |

The average growth rate per year for annual energy ranges between 1.8% - 3.1% from 2027-2046; it ranges between 1.9% - 3% for peak demand over those two decades.

These results shouldn’t be considered final yet, because this load forecast shows higher levels of electricity consumption in peak demand and in annual energy than will actually occur over the next two decades. It doesn’t account for energy efficiency and demand response, which lowers energy consumption and makes it easier to manage. In the months to come, we’re going to be evaluating how much energy efficiency and demand response is cost-effective and should be included in the Ninth Plan’s resource strategy.

For example, the forecast assumes electric vehicles will use unmanaged charging that could coincide with other peak periods of the grid, like the after-work hours in the evening. EV charging could be managed in several ways that lessens peak-period stress, such as delaying charging until after midnight. This demand response potential is available as an option that the Council’s resource modeling could pick for the Ninth Plan’s resource strategy.

Data centers, electric vehicles, and hydrogen

Data centers and the tech sector in the Northwest, electric vehicles, and hydrogen and industrial electrification are three significant sources of future load growth, albeit with uncertainty about the timing, pace, and amounts. The Council has broken these three categories out to highlight how we’re planning for them and analyzing them.

- Data centers: Of all the sources of future energy demand in the Northwest, data center and high-tech loads have the greatest uncertainty. To address this uncertainty, the Council developed three forecast trajectories to reflect different growth trends, with most the growth in the next five years.

- Electric vehicles: Load growth in this sector is primarily driven by policies in Oregon and Washington, but mainly occurs after 2030. This demand grows over time, resulting in load that could contribute to peak demands on the system if it’s not managed.

- Hydrogen: This forecast covers hydrogen for non-power uses, which could also be used to represent other industrial electrification. These loads are slower to build, but still have the potential to be significant in the long term.

New resource options

To meet these growing and evolving needs for energy, the Council’s computer modeling will have a menu of supply- and demand-side resource options to test and analyze. Modeling results will aid Power Division staff and the Council Members as they evaluate future buildouts of the Northwest power system to meet the Power Act’s legal mandate of an adequate, efficient, economical, and reliable power supply.

Supply-side resource options in the Ninth Plan

Earlier this spring, Power Division staff briefed the Council on generating resources’ reference plants for the Ninth Plan. These specify attributes like capacity, transmission access, or location, as well as financing and costs. These estimates and assumptions were checked with the Generating Resources Advisory Committee, which consists of Northwest utilities, energy providers, experts, and other regional partners.

The primary supply-side resource options we’re evaluating for the Ninth Plan are land-based wind, solar, short-duration battery storage, and natural gas plants. Other resources options include off-shore wind, pumped storage, and geothermal. The Ninth Plan also uses proxies for emerging technologies – covering clean long-duration storage, clean baseload, and clean peaker/medium duration storage – so models can evaluate and assess needs for their general attributes without being overly prescriptive on technologies whose costs and timelines to commercial viability are uncertain. Clean-long duration storage is based on an iron-air battery, clean peaker/medium duration storage is based on a hydrogen peaker with on-site electrolysis, and clean baseload is based on a small-modular nuclear reactor.

Some resources like wind, solar, batteries, and natural gas plants are assumed to be available at the beginning of the Ninth Plan’s timeline in 2027, while others such as pumped storage, offshore wind, and emerging technologies will be available later. Through scenario modeling the Council will explore how the optimal resource strategy changes as costs and availability of resources change.

Demand-side resources

In June, staff briefed the Council on the final results for assessing the 20-year potential for energy efficiency and demand response. Staff provided a presentation on potential for rooftop solar in the Northwest in April.

Demand side potential over the next 20 years, compared with the 2021 Plan

| Ninth Plan (approximate) | 2021 Plan (approximate) | |

| Energy efficiency | 5,000 aMW | 5,100 aMW |

| Demand response | 4,100 MW (summer) 3,500 MW (winter) | 3,700 MW (summer) 2,750 MW (winter) |

| Rooftop solar | 4,000 aMW | n/a |

This is technical achievable potential. We’ll be using apples-to-apples comparisons with supply-side options to determine how much of this is cost-effective and should be included in the Ninth Plan’s portfolio.

Similar to the supply-side, the Ninth Plan will test emerging demand-side technologies, which increases the total technical achievable potential to roughly 7,000 aMW over the next two decades.

Scenario modeling - Transmission system expansion, resource costs and availability and Columbia Basin hydro operations

The Ninth Plan has two priority scenarios to analyze, one regarding resource and transmission risk, and the second focusing on Columbia Basin hydro operations.

Recently, the Pacific Northwest – and many other areas of the U.S. – have experienced lengthy timelines for developing new electricity generation resources, transmission lines, and other power system infrastructure that helps deliver power from where it’s generated to where it’s needed.

While the Council does not do transmission system planning, transmission availability and capacity are an increasingly important element to the Council’s power planning. In scenario modeling, the Council will be exploring three different transmission looks. This will inform key questions, such as, what if delays in building transmission continue into the future in the Northwest? How will the region still be able to maintain an adequate power system? What if things change and the pace of development accelerates? Our resource modeling will seek to answer those questions in the winter of 2025-26. In September, Power Division staff briefed the Council on the scope of the resource-and-transmission risk scenario.

For the transmission work, the Council plans to rely on the analysis of the Western Transmission Expansion Coalition to inform potential transmission availability. The WestTEC is an industry-led initiative that convenes states, BPA, utilities, tribes, public interest groups, energy providers, and transmission companies, among others.

As part of this scenario, the Council also will look at the pace and costs of resources:

- Constrained new resources: By limiting supply side resources and assuming no new transmission gets built, what resources are needed to ensure an adequate system?

- Changing emerging technology costs: How does uncertainty for the cost of emerging technologies impact new resource acquisition?

- Limited short-duration battery availability: How would new resource acquisition change if the Northwest was limited in how much battery storage it could add?

- Slower demand side resource availability: How would new resource acquisition change if demand side resources took longer to develop?

- Evolving federal policy landscape: How do policies at the federal level impact resource decisions in our region?

For the second scenario, the Council will look at different hydro conditions in the Columbia Basin. This purpose of this scenario is to understand how uncertainty around hydro operations changes the future resource needs. This focuses on exploring impacts of different spill regimes, different minimum operating pool targets, and daily flexibility of the hydro system.

Future Columbia Basin streamflow conditions and climate modeling

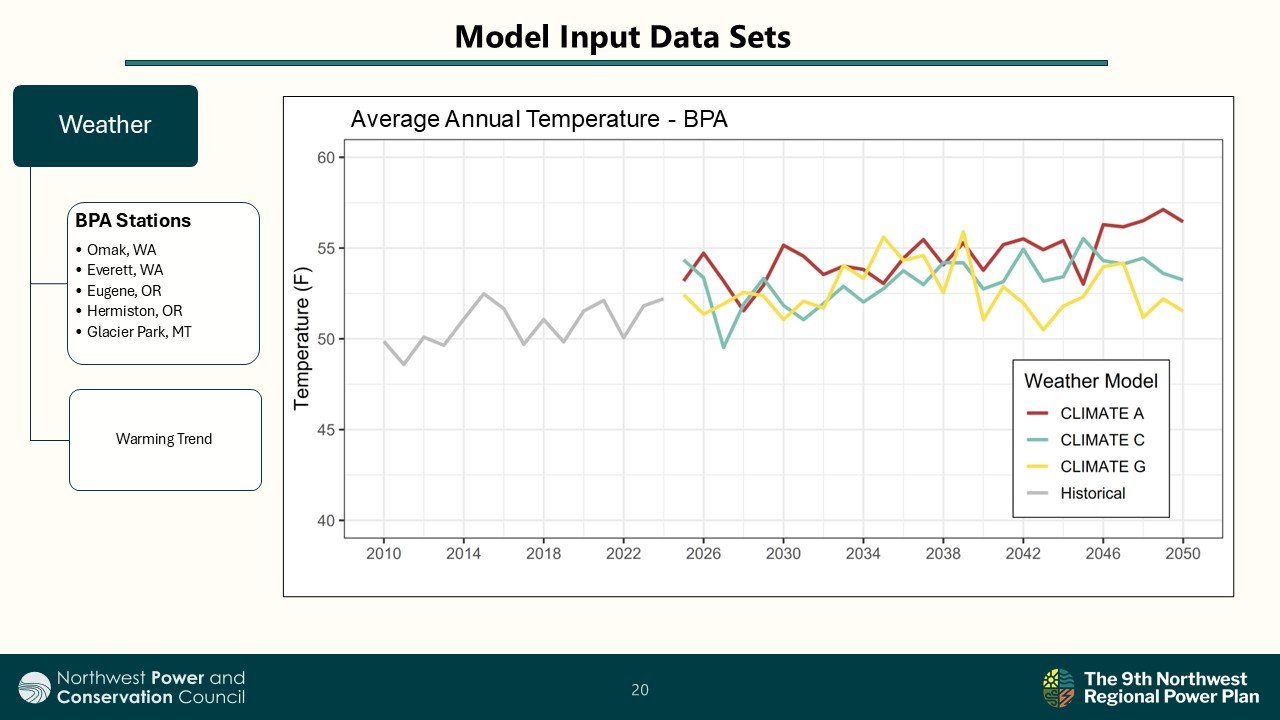

We use climate model data to inform our load forecasts, hydro operations, and wind profiles.

In preparation for the Ninth Plan, the Power Division staff explored how well this data has captured extreme events. Many of the recent events experienced in the Northwest have been captured within the existing datasets, including the 2021 summer heat dome and the January 2024 winter storm.

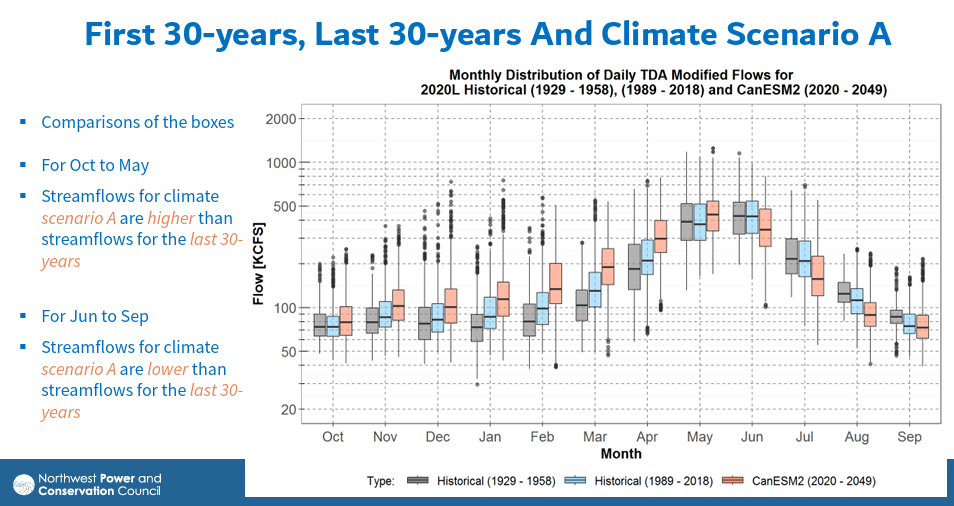

Staff met with the Climate and Weather Advisory Committee, consisting of climate scientists and technical experts in the Northwest, to review this data in 2024-25. We use three climate futures in our modeling; climate scenario A has the warmest future temperatures.

For streamflow conditions, our computer modeling includes daily stream flows available for 76 hydro-projects and gauging stations in the Columbia River Basin. These datasets are provided by the River Management Joint Operating Committee.

Some of the key takeaways regarding future streamflow conditions at The Dalles looking out to 2050 (which impacts future hydropower generation in the Columbia Basin) are:

- Higher winter river flows, leading to higher hydro generation. Higher winter temperatures in some years result in lower load.

- In contrast, projections for summer expect generally lower hydroelectric generation, and higher electricity demand due to more heatwaves and higher temperatures.

Staff compared the next two decades with the observed streamflow at The Dalles from 1929-1958, and from 1989-2018. Each month in the future years (going out to 2049), still shows a wide variation in streamflow conditions, meaning there will still be many very wet years along with very dry years. This is a characteristic of the ranges from 1929-1958, and from 1989-2018.

See more from the future climate scenarios and streamflow conditions datasets, including streamflow conditions for climate scenarios C & G.

Early results to date: Needs assessment and west-wide market availability

An early step in modeling is understanding the future needs for new resources based on the forecasted load. The Council does this leveraging its new, innovative method to protecting the Northwest power grid’s resource adequacy. We now use multiple metrics to plan for resource adequacy.

Many electricity grids in the U.S. still use a one-day-in-10-years adequacy standard. While that gauges the potential frequency of an energy shortfall, it doesn’t provide information about its magnitude or duration, or the season in which it will occur. Under a one-day-in-10-years standard, we were concerned that a major energy shortfall could masquerade itself and be permitted to occur.

With a multi-metric approach, it is now possible to understand the shape, size, duration, and seasons of adequacy issues. This is a major advancement in helping the Council and the region plan for needed solutions. We are one of the first power planners in the U.S. to adopt this multiple-metric resource adequacy standard.

The Council presented the first results of the needs assessment in October. The key takeaways were:

- The modeling shows significant needs for the region in 2031. This was to be expected because of the way needs assessment studies are designed. The Council’s study froze electricity grid resource development at current levels, yet allowed loads to grow to 2031 levels. Analyzing the gap helps to ensure the Ninth Plan will deliver an adequate power supply in the future.

- Needs are seen across all seasons, but the largest and longest gaps appear in the winter

- The expected load growth is the largest driver of the needs seen in this study

- Uncertainty around hydro operations is less of a driver for needs than future load growth

- Peak challenges are greater than energy challenges, meaning that a portfolio of supply- and demand-side resources will be needed to meet both peak and energy needs identified in these studies throughout the year

West-wide market availability

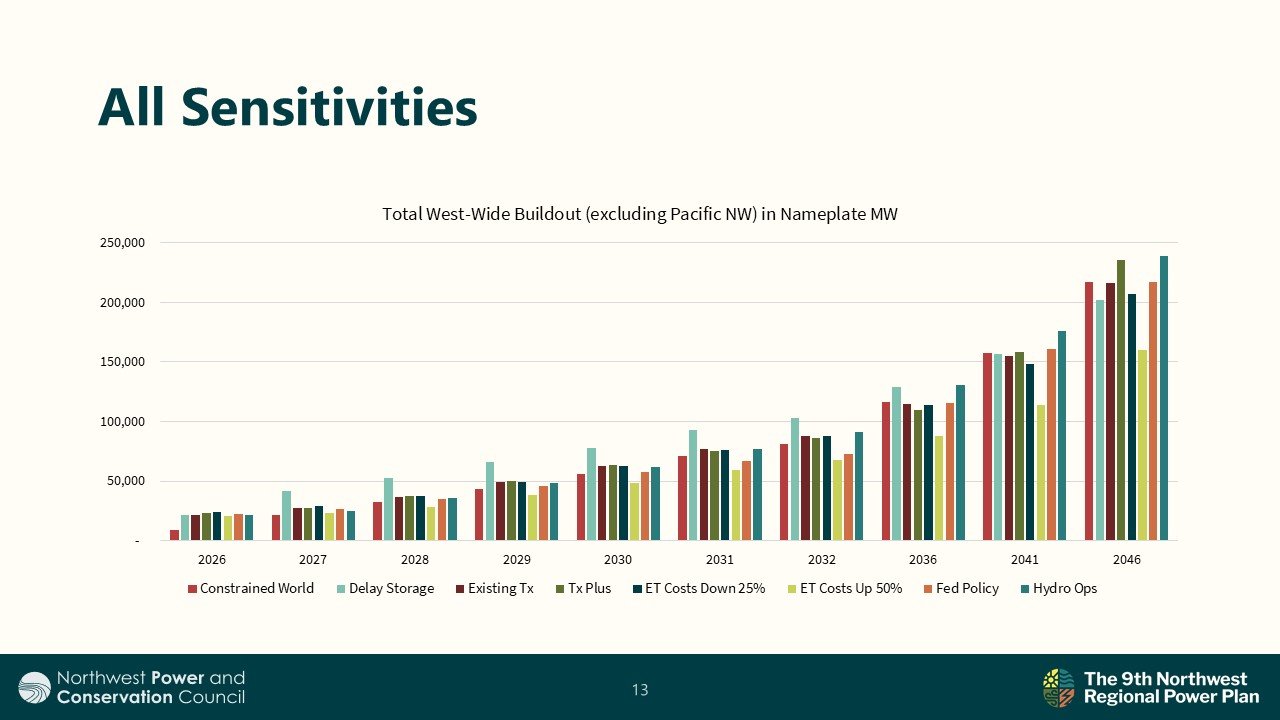

As part of the scenario modeling, the Council conducts studies on west-wide market availability. These look at new resource builds across the Western Interconnection over the next 20 years. Read the staff presentation to learn more about each sensitivity we tested.

This study helps to inform what resources are available on the market to support both economics and adequacy in the region. The results of this study showed:

- Market availability does not change significantly across the various sensitivities. The 20-year buildouts are remarkably similar. The near-term buildouts shift a bit, primarily where there are limitations in resource (and particularly short-duration storage) availability.

- Key drivers of the builds are load growth and state policies, specifically carbon pricing in California, Washington, and Canada.

- Majority of resources built across all sensitivities are a balance of renewables, storage (both short and longer duration), and natural gas.