- 6-A. Cost-Effective Conservation

- SIDEBAR--Utilities and Conservation: A New Paradigm

- How Much Conservation has the Region Achieved?

- How Much Remains to be Done?

- Conservation's Benefits, Uncertainties and Risks

- Analysis of the Long-Term Benefits of Conservation

- Effect of Fuel Price, Demand and Hydropower Uncertainty

- Additional Risks and Uncertainties

- Net Annual Expenditures for Conservation Over Time

- Will the Remaining Cost-Effective Conservation Be Achieved?

- Consumer-Developed Conservation

- Conservation Developed by the Competitive Market

- Conservation Development Experiences in More Competitive Markets

- Conservation Program Evaluations and their Estimation of Market Effects

- Additional Opportunities for Conservation Development

- Options for Conservation Development in the Long-Term

- SIDEBAR--Conservation: What to Do Now

- 6-B. A Renewable Energy Strategy

- SIDEBAR--Why People Support Renewables

- Renewables Activities - 1991 to the Present

- Prospects for Development of Renewable Energy Resources

- Value of Renewables Available for Development

- Value of Accelerated Renewables Development

- Findings Regarding a Near-Term Strategy

- Conclusions: Justifiable Elements of a Renewable Resource Strategy

- 6-C. Environmental Considerations

- Environmental Mitigation in Competitive Electricity Markets

- Global Climate Change

- SIDEBAR--International Response to the Climate Change Issue

- Special Difficulties of the Climate Change Issue

- Managing Risk to the Power System

- Analytical Approach

- Power System Cost Analysis

- Regional Actions While Climate Change is Uncertain

There are some resource issues that present a particular challenge in a competitive market. These include developing cost-effective conservation resources, maintaining progress on renewable resources and incorporating environmental considerations in resource decisions. Each of these is discussed in this chapter.

6-A. Cost-Effective Conservation

One of the goals of the Northwest Power Act is to achieve cost-effective energy conservation. However, conservation faces a radically different environment today than it did in prior Council power plans:

- The alternative resource costs avoided by conservation are substantially lower, leaving fewer conservation measures cost-effective by comparison.

- Retail prices for electricity can be expected to move closer to marginal costs, reducing or eliminating one of the economic arguments for utility funding of conservation.

- Competitive pressures make it difficult for utilities to spend money on conservation programs.

These changes, taken together, mean that utilities, including the Bonneville Power Administration, will be unable to secure all the remaining cost-effective conservation as they did in the past. Bonneville is a special case. The agency has long supported efficiency efforts through its public utility customers. As Bonneville began to redesign its approach to conservation, it asked its public utility customers to underwrite more of their own programs. Bonneville at first agreed to provide back up if the utilities were unable to secure enough energy savings to meet regional goals set in the 1991 Power Plan. However, because the public utilities can purchase electricity in a market where other providers do not finance conservation, the Council doesn't expect Bonneville to continue supplementing public utility efforts to meet regional conservation goals.

Nonetheless, cost-effective conservation is still an important resource, and the region must be open-minded and creative in finding new ways to capture the economic and environmental benefits conservation can provide. The Council suggests that the Comprehensive Review and appropriate state forums evaluate the costs and benefits of new mechanisms to acquire conservation beyond what will naturally be developed in the market. The goal should be a competitive market that preserves as much of the conservation benefit as possible.

This section assesses how much cost-effective conservation is available, its benefits and risks, how much will likely be adopted by the market, and what kinds of conservation measures will be a challenge to secure without some extra-market effort. If additional mechanisms for acquiring energy savings are needed, can they be cost-effectively implemented without interfering with the operation of a competitive electricity market?

|

Utilities and Conservation: A New Paradigm In the 1970s and 1980s, the costs to build new generating resources were generally higher than the costs of existing resources. Electricity prices were usually based on average costs, so the revenue from new loads did not cover the costs of building new resources to serve new loads. Serving new loads raised everyone's prices. Utilities became vehicles for spreading the costs of new resources (of whatever type – generation or conservation) among customers, whether or not the customers contributed to load growth. Customers who shared the cost of other customers' service tolerated the situation because their energy bills would have been higher yet if they left the utility to self-generate. In that world, it was reasonable for utilities to have an important role in acquiring conservation. They were already in the business of spreading new-load costs among all customers. Sharing the cost of conservation, while more contentious than sharing the cost of new generation, was not fundamentally different. If a conservation measure reduced the total cost of meeting load growth, it was possible (though not simple) to make all customers better off. Because self-generation was unattractive compared to utility service, and transmission access was restricted, utilities' monopoly franchise was relatively safe, and utilities could impose some cost-shifting on their customers without disastrous effects on their stockholders. The world today is much different. Lower natural gas prices, better generating technologies and the opening of transmission and, possibly distribution, access have or will combine to make it attractive for some customers to leave utilities for independent suppliers or self-generation. Utilities are beginning to respond to this threat by offering these customers prices that approach the marginal cost of service. If competition develops fully, utilities will not be able to allocate to these customers any part of other customers' costs of service (generation or conservation). To the extent that customers do not share others' costs of generation, much of the rationale for sharing the costs of conservation disappears, along with the utility's ability to do so. In a competitive world, new-load revenues cover their own costs, except for environmental externalities. Other customers are mostly indifferent to the efficiency of use by new loads, since new loads pay their own way. As a result, a fully competitive utility cannot sustain cost transfers among customers for investments in conservation, even if the conservation is cheaper than generating alternatives. The utility industry as it stands today is not fully competitive. For example, utilities still have monopoly franchises, and marginal retail prices for some customers do not equal marginal costs. Most utilities, however, are anticipating competition, if not already experiencing some of its manifestations. As a result, the exact role of conservation in the changing world is unclear. Many utilities are taking a cautious attitude toward the further development of conservation as a resource during this current period of uncertainty. Investments in conservation, mostly up-front capital investment, run the risk of becoming stranded investments in a competitive marketplace. Many utilities will continue to pursue conservation because their customers and governing boards want them to do so. But it is unlikely that the part of the electricity business that is competitive will have an interest in, or be able to sustain, large investments in conservation over the long run, unless that conservation is directly funded by the customer who installs the measures. |

How Much Conservation has the Region Achieved?

The Northwest has made great strides toward improving the efficiency of its electricity use. As described in Chapter 4, during the 15 years following the passage of the Northwest Power Act in 1980, the region's consumers secured nearly 1,000 average megawatts of energy-efficiency improvements through utility conservation programs. Utilities paid about half as much for these energy savings as they would have had to pay for alternative electrical resources available during that period.

In addition, there were substantial efficiency gains from improved residential and commercial energy codes. The two most populous states in the region, Oregon and Washington, and several local jurisdictions in Idaho and Montana, adopted energy codes for new residential and commercial buildings that meet the Council's original model conservation standards. These codes, among the most rigorous in the nation, have already resulted in significant savings. They will continue to add hundreds of megawatts of cost-effective savings over the next 20 years and beyond. The work of state energy offices and local governments, combined with Bonneville and utility support, has been critical to the adoption and implementation of these codes.

At the federal level, minimum efficiency standards were established for major residential appliances. The federal energy standards for new manufactured homes were also revised for the first time since 1976. And the National Energy Policy Act of 1992 established new efficiency standards for some lamps, lighting equipment, electric motors, commercial heating, ventilating and air conditioning equipment, and shower heads. These standards will result in savings that do not have to be sought through utility programs.

How Much Remains to be Done?

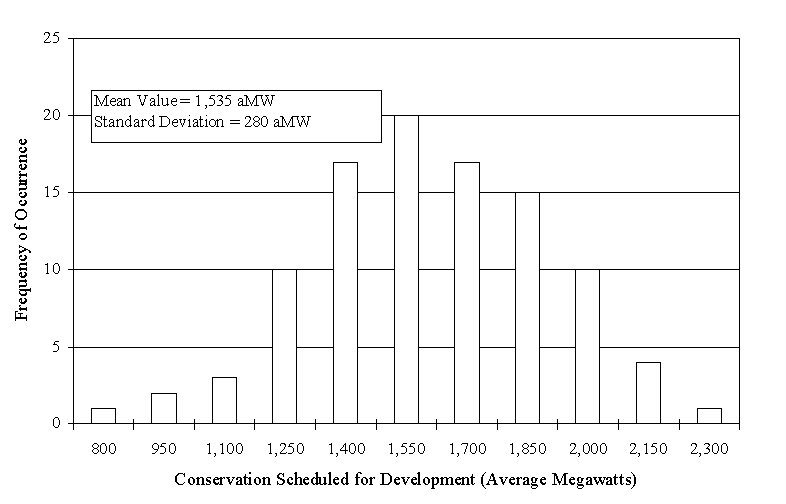

The amount of conservation that is cost-effective to develop depends upon how fast the demand for electricity grows, future alternative resource costs and year-to-year variations in water conditions. [For example, if economic growth follows the Council's medium-low forecast, the region will need to add approximately 145 average megawatts of new resources each year. However, if regional economic growth is at the Council's medium-high forecast, nearly 425 average megawatts of new resources will be needed each year.] Figure 6-1 shows the amount of conservation that would be cost-effective to develop across a wide range of future electricity use patterns, gas prices and hydropower availability. The amount ranges from a low of about 800 average megawatts, when demand growth and gas prices are low, to a high of about 2,300 average megawatts, corresponding to a future of high demand and high gas prices. The average amount of regionally cost-effective conservation the Council has identified is approximately 1,535 average megawatts. [This is the total amount of conservation achievable, given sufficient economic and political resources, over a 20-year period in the medium forecast. The 1,535 average megawatts of cost-effective potential identified in this plan is very different than the 1,500 average megawatts referenced in the 1991 plan. In this draft plan, the 1,535 average megawatts is the average amount of conservation developed in a 20-year period across all potential futures (such as low and high gas prices or load growth). In the 1991 plan, the 1,500 average megawatts was cost-effective achievable conservation over a 10-year period assuming medium-high load growth.]

Figure 6-1. Distribution of Energy Savings Developed in Alternative Futures

Table 6-1 shows the conservation savings potential by sector and end-use. Approximately one third of this potential is in new and existing non-aluminum-industry facilities. The Council has not estimated the amount of conservation that may be available in the aluminum industry, but there is undoubtedly some additional potential in that sector as well. The next largest source of potential savings is in residential water heating and laundry equipment, which represents about one-fifth of the total potential. New residential and commercial buildings make up about one-quarter of the cost-effective potential. The remaining potential is spread among existing residential buildings and appliances, existing commercial buildings and irrigated agriculture. The average levelized cost of these resources is approximately 1.7 cents per kilowatt-hour. [These levelized costs do not include the 10-percent credit given to conservation in the Northwest Power Act.] This is roughly two-thirds of the cost of new generating resources.

Table 6-1. Average Achievable Conservation Potential by End Use or Sector

Conservation's Benefits, Uncertainties and Risks

The development of cost-effective conservation is the highest priority electricity resource in the Northwest Power Act. To be considered "cost-effective," conservation must be less costly than the next similarly available and reliable generating resource. The goal of each Council power plan has been to find the mix of conservation and new power supplies that produces the lowest total present-value cost of meeting the region's energy service needs. In the near term, to be cost-effective, the levelized cost of a conservation resource must be less than the estimated levelized cost of market purchases from out of region. Once the transmission system cannot accommodate further purchases from outside the region, conservation must have a lower levelized cost than new natural gas-fired combustion turbines.

The Council has historically viewed the costs and benefits of investing in the region's energy future from a long-term perspective. It has tried to weigh the costs of investments made in new resources over the 20-year planning horizon against the benefits they could return to the citizens of the Northwest over the resources' useful lives. The fact that people tend to place greater weight on near-term costs and benefits than those that might occur far in the future is accommodated by discounting future costs and benefits. [For this plan, a base discount rate of 4.75 percent was used.]

Conservation investments have three characteristics that must be taken into consideration in this sort of long-term perspective. First, the costs of conservation are virtually all capital. This means there are no operating costs that can be avoided if, for example, demand grows less quickly than expected or fuel prices fall. Second, for this analysis we have assumed that all energy savings are amortized over 15 years, even though some savings have much longer useful lives. This means the costs are front-loaded, while the benefits are frequently spread out over a longer period. Finally, some of the conservation is very long-lived. As a result of all these factors, a long-term perspective exposes conservation investments to uncertainty and risk.

Countering these characteristics is the fact that the investment in conservation is made incrementally. On average, the pace of acquiring all 1,535 average megawatts of cost-effective conservation would be about 75 average megawatts per year. This means that the region can (and should) regularly revisit the economic merits of further investments in conservation. This limits the risk of potential over-investment. In the following paragraphs, the analysis of the long-term value of conservation is described along with the effects of key uncertainties and risks.

Analysis of the Long-Term Benefits of Conservation

The analysis was structured to estimate first the conservation that is likely to be developed as a result of the momentum of current utility programs and what consumers acting on their own are expected to secure in the longer term. This amounts to 515 average megawatts of conservation available at an average cost of 1.9 cents per kilowatt-hour. This conservation was assumed to be implemented on a fixed schedule: 70 average megawatts per year the first two years, 60 average megawatts per year the next two years, 30 average megawatts the fifth year and 15 average megawatts per year thereafter. The levels and schedule were estimated from a survey of current utility plans, and by identifying those resources that consumers would be more likely to adopt on their own, such as those that increase productivity in an industrial plant.

The remaining conservation was grouped into levelized cost increments of between 1.0 cent per kilowatt-hour and 4.0 cents per kilowatt-hour. These resources were assumed to be developed to meet loads as needed. The most cost-effective resources were developed first.

Table 6-2 shows the average present-value benefit to the region of developing each of the conservation resources. Also shown are the total tons of carbon dioxide offset by the conservation. This could become important should a carbon tax be required to mitigate global climate change.

Table 6-2. Regional Benefit of Conservation Resource Development

[The present-value benefits shown in Table 6-2 do not include the 10-percent credit provided conservation in the Northwest Power Act.]

| Conservation Block | Average Present Value ($ Millions) | Average Megawatts | Carbon Dioxide Offset (Millions of Tons) |

| Utility Momentum Plus Market Driven |

$ 570 |

515 |

27 |

| Less than 1.0 Cents/kWh |

$ 760 |

310 |

16 |

| More than 1.0 and less than 2.0 Cents/kWh |

$ 830 |

525 |

27 |

| More than 2.0 and less than 3.0 Cents/kWh |

$ 140 |

185 |

10 |

| Total |

$ 2,300 |

1,535 |

80 |

As can be seen in Table 6-2, the average total present-value benefit of developing the region's remaining cost-effective conservation potential is $2.3 billion. Investments in conservation, beyond those anticipated to be made by utilities and consumers, could secure $1.7 billion in benefits ($2.3 billion minus $570 million). To place these values in perspective, the estimated present-value cost for all resources, except conservation, needed to meet the region's electricity load growth over the next 20 years is $27.7 billion. By making these cost-effective investments in conservation, this "bill" could be lowered to $25.4 billion.

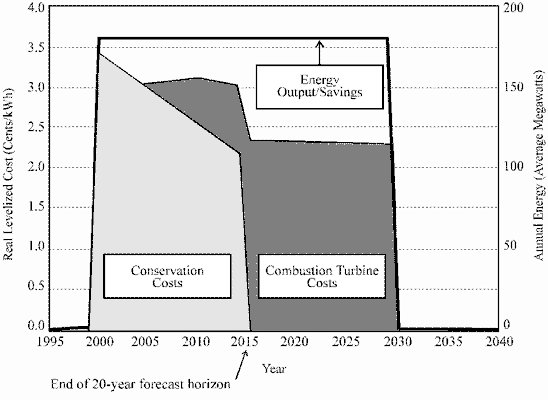

It is important to acknowledge that the majority of the benefit shown in Table 6-2 occurs over the long term, beyond the 20-year planning horizon. The power plan looks at the value of resources developed over 20 years to meet load growth. However, for a resource built in any given year that has a longer lifetime than the 20-year forecast horizon, the costs and benefits of that resource for its entire lifetime are counted. Consider, for example, either a combustion turbine or an equivalent amount of conservation developed in 2000. Both are financed over 15 years, both have 30-year lifetimes and both will produce or save kilowatt-hours well beyond the 2015 forecast horizon. Figure 6-2 shows the cost profile for these two resources over time.

If these two resources were evaluated only up to the year 2015, all of the costs of the conservation would be included, but the fuel and maintenance costs of the combustion turbine after 2015 would be missed. Until the year 2015, the two resources are fairly comparable in total costs, and both resources produce an equal amount of benefits (i.e., energy). But after 2015, conservation continues to produce savings for the region at very minimal cost. The turbine produces value after 2015, too, but at much higher cost. To capture the benefits and costs of resources acquired by 2015, the costs and benefits over their entire lifetimes need to be incorporated. The effects of uncertainty regarding future electrical generation costs have been addressed in the Council's analysis and are discussed below.

Figure 6-2. Resource Costs and Benefits Valued Over Their Productive Lifetimes

Effect of Fuel Price, Demand and Hydropower Uncertainty

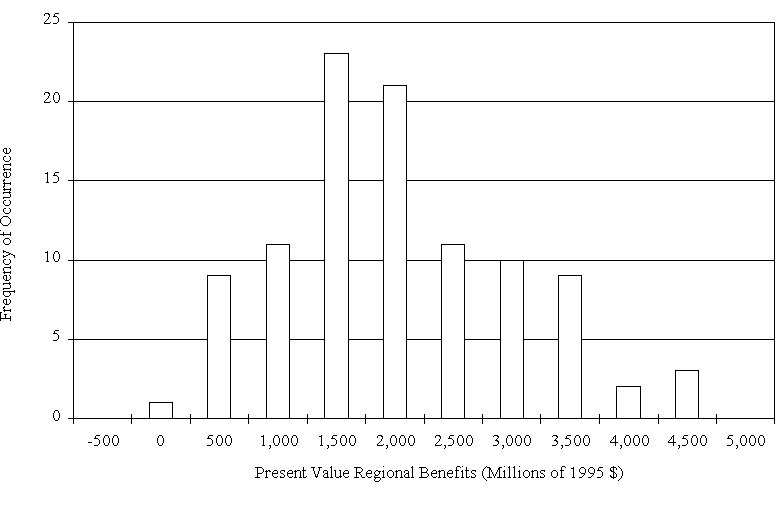

While the average present value of the conservation is of interest, it is important to have a sense of how that value might change with respect to the uncertainty in fuel prices, demand growth and hydropower conditions. Figure 6-3 shows the distribution of present-value benefits produced by the investments in conservation. The acquisition of this additional conservation produces a benefit to the region of between $0 and $4.5 billion over the next 20 years, with an average of $2.3 billion, as reported above. The range of values is a result of the specific combination of economic growth, fuel prices and hydroelectric availability the region experiences over the next 20 years.

On a long-term basis, the conservation investment is robust, with the region always being better off if it invests in conservation. The reason conservation remains valuable over the wide range of futures modeled here is because the conservation is relatively low cost and the cost-effectiveness of additional investments in conservation are continually assessed as the region invests over time. In futures in which low load growth and/or low gas prices occur, the region slows its investments and develops much less than 1,535 average megawatts. The range of conservation development due to such factors is shown in Figure 6-1. Conservation's characteristic of being developed in increments over time is valuable, because decisions about additional development can be deferred until the savings are needed. If the region were to commit today to developing exactly 1,535 average megawatts over the next 20 years, without adjusting for load growth or other factors, there would be a significant number of cases in which present-value costs exceed the benefits.

Figure 6-3. Distribution of Present-Value Benefits of Conservation Over Full Resource Life

Additional Risks and Uncertainties

The Council's base-case analysis accounts for much of the uncertainty associated with fuel prices, demand and hydroelectric conditions. However, there are additional uncertainties and risks to which conservation investment is exposed. While some of these risks reduce the average value of the conservation, in all cases there remains significant value. There are also risks that significantly increase the value of conservation. Many would argue that these risks are at least as likely as those risks that reduce the value of conservation.

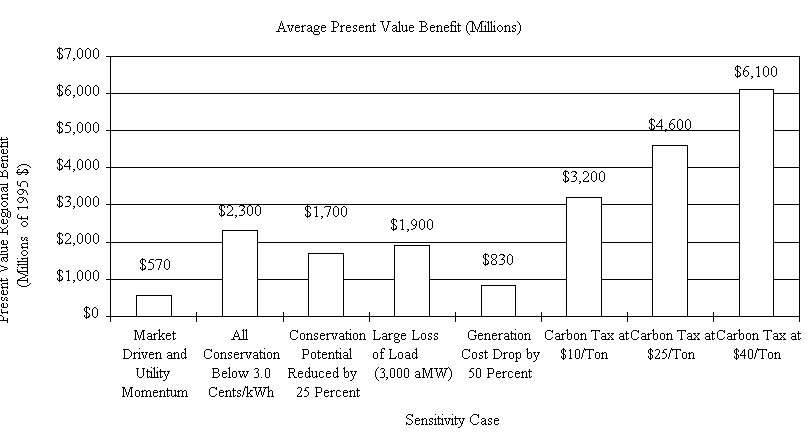

Figure 6-4 illustrates the base-case analysis and multiple sensitivity analyses that were conducted.

Figure 6-4. Summary of Conservation Sensitivity Study Results

Market driven and utility momentum: The first bar in Figure 6-4 illustrates average present-value savings to the region if conservation is developed through utility momentum and the market. This is not all the cost-effective savings that could be acquired over the 20-year forecast horizon.

All conservation below 3.0 cents per kilowatt-hour: The second bar shows average present-value savings if all cost-effective conservation is developed. The remaining sensitivity cases in the figure are described next.

Conservation potential reduced by 25 percent: The Council relies on the best information and analysis it can produce in estimating the amount of conservation available for development. However, those estimates are subject to some uncertainty. Some parties have criticized the analysis for estimating too much conservation, others for estimating too little. To evaluate the risk associated with overestimating the conservation potential, the analysis was re-run using the proposed lower estimates of achievable potential – a reduction of about 25 percent. This reduces the average present value of conservation from $2.3 billion to $1.7 billion.

Large loss of firm load: The primary risk the region takes in purchasing conservation is that once the capital is invested it can no longer be used for some other purpose. Virtually all of the cost of conservation is a fixed, up-front capital cost, which is repaid in savings over many years. Once the capital is spent on a conservation measure, there is no simple way to recover its value, other than to wait for the savings to accrue. If the region were to suddenly lose a large amount of load, some of the conservation investment would not be needed.

This possibility was investigated by assuming that the region loses 3,000 average megawatts of electrical load in the year 2005 as a result of industrial plant closures or economic downturn. In this scenario, the development of cost-effective conservation still provides the region with $1.9 billion in present-value savings, compared to $2.3 billion in the base case. This is a result of three factors. First, because the region is already relying heavily on market purchases to meet its needs, it can respond to rapid changes in loads by curtailing purchases. Second, less than 10 percent of the conservation that is typically developed by the year 2005 has a levelized life-cycle cost to the region of more than 2.0 cents per kilowatt-hour. Since it is less expensive than continued market purchases, it retains its value to the region. Third, because the conservation is implemented incrementally at about 75 average megawatts per year, further conservation investment can be reduced when the loss of load occurs.

Cost drop by 50 percent: Another way in which conservation investment could be at risk is if there were some dramatic and unanticipated improvement in generation technology that would reduce the value of conservation savings. This was tested by assuming that some technological breakthrough reduces the cost of new generation by nearly 50 percent (to 1.5 cents per kilowatt-hour) in the year 2005 and that this source of power is immediately available to serve all regional loads. The costs of this resource were assumed to be all variable costs, and thus it would have complete flexibility to be turned on and off to meet load fluctuations. Should this occur, it would reduce conservation's average present-value benefit to the region to approximately $800 million.

Carbon tax added: Not all the risks the power system faces are adverse to conservation. As is discussed later in this chapter, there is the risk that measures might be imposed to reduce emissions of carbon dioxide and other greenhouse gases thought to be contributing to global climate change. This risk was simulated by assuming a tax of between $10 and $40 per ton of carbon dioxide is implemented in 2005. Such measures could increase the value of conservation to the region by between $3.2 and $6.1 billion.

Net Annual Expenditures for Conservation Over Time

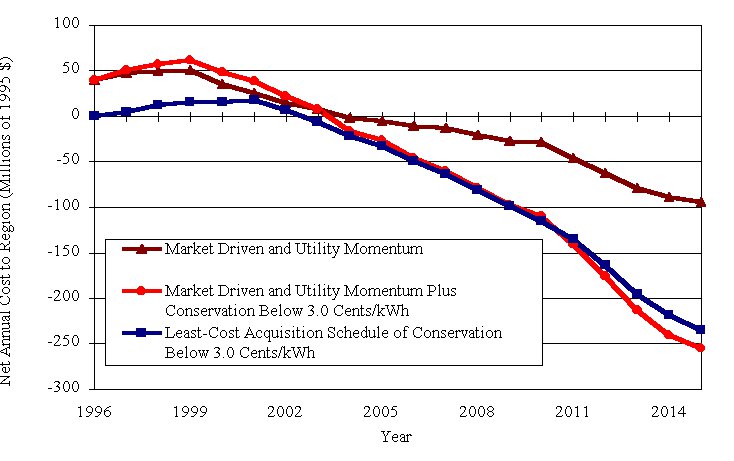

As noted above, conservation requires more money up front than purchasing electricity from the West Coast market in the near term. In the longer term, however, conservation reduces yearly expenditures for power purchases and defers new power plant additions. The Council compared the yearly cost of developing conservation versus buying power from the market in the near term and developing gas-fired generation in the longer term to assess the magnitude of the near-term risk created by purchasing conservation. Figure 6-5 shows the annual net cost to the region of acquiring conservation by the year 2015 under three different acquisition schedules.

The first schedule shows the annual net cost of acquiring the 515 average megawatts of conservation utilities are already planning to acquire plus the conservation the market might accomplish on its own. This is labeled "Market Driven and Utility Momentum." The second schedule, labeled "Market Driven and Utility Momentum Plus Conservation Below 3.0 Cents per Kilowatt-Hour" adds the annual net cost of capturing the remaining cost-effective conservation to the 515 average megawatts developed in the first schedule. The third schedule, labeled "Least-Cost Acquisition Schedule of Conservation Below 3.0 Cents per Kilowatt-Hour" develops all conservation in least-cost order. The "zero" line represents the cost of relying on market purchases and new gas-fired generation in lieu of capturing any conservation. A positive figure represents net cost to the region, while a negative figure represents a net savings.

As shown in Figure 6-5, the combination of utility program momentum and consumer actions, results in a pace of conservation acquisition that will require an investment of about $40 million annually more than the cost of relying on alternative resources through the year 2003. [Of the 700 average megawatts of conservation needed to meet load growth through the year 2003, approximately 335 average megawatts are anticipated to be developed by utilities and consumers without further market intervention.] Developing the additional conservation needed to meet load growth would add only approximately $7 million per year in "new" investments beyond those anticipated to result from current utility plans and market expenditures. [It should be noted that actual utility expenditures are expected to be only a portion of this amount due to consumer cost-sharing.]

Net costs are higher in the early years because so much of the conservation results from utility programs and contract commitments that have not been fully adjusted to the lower avoided costs the region is now seeing. As a result, some of this conservation is more expensive than that which would be acquired on a least-cost basis. However, if the region's consumers and utilities are able to develop lower-cost conservation first, roughly the same amount of conservation is acquired, but at about one-third of the annual net cost. This can be seen by comparing the line labeled "Least Cost Acquisition Schedule for Conservation Below 3.0 Cents per Kilowatt-Hour" to the other two lines in Figure 6-5.

Figure 6-5. Annual Net Cost of Conservation Resource Acquisitions

Compared to Reliance on Power Purchases and New Generating Resource Acquisitions

Will the Remaining Cost-Effective Conservation Be Achieved?

It appears that the region could secure significant economic benefits by developing its remaining cost-effective conservation. In the past, Bonneville and the region's utilities were positioned both economically and institutionally to acquire all cost-effective conservation. Competition is changing that. Before discussing whether there is a need for new alternatives, this section discusses how much conservation the region might reasonably anticipate being developed by utilities, consumers and the energy service industry in response to the evolving competitive market.

Utility-Funded Conservation

Historically, Bonneville and the region's utilities have served as the primary agents for conservation resource development in the Northwest. In the near term, the Council's survey of electric utilities indicates that they intend to continue to acquire approximately 250 megawatts of energy savings by the year 2000, or about 60 to 70 megawatts per year.

Among public utilities, informal surveys indicate that many want to continue to offer energy saving opportunities to their customers both as a service and to achieve conservation at lower utility costs. Many of these utilities are augmenting Bonneville funds, carried forward from previous years, to continue conservation over the next few years.

The investor-owned utilities are operating under least-cost planning orders from their regulators. While many of these utilities have reduced their expenditures on conservation, in large part because of the declining avoided cost, they have still committed to developing fairly large amounts of the conservation resource in the next few years. [Avoided costs have come down dramatically since the early 1990s, and as a result, less conservation is cost-effective. This means that the yearly amount of conservation that is targeted by utilities is less than it once was, but in the next few years it is still significant.] Many of the investor-owned utilities have indicated that their plans to carry out conservation programs in the near-term are designed to help position them for a more competitive world in the long-run. This includes reducing the cost of utility conservation programs, focusing on markets where competition could cause the loss of customers, and favoring consumer information and loans over rebates.

As competitive pressures increase, both public and investor-owned utilities are expected to further reduce their efficiency efforts.

Consumer-Developed Conservation

Consumers will continue to develop some conservation on their own, regardless of the actions of utilities or other parties. Consumers invest in conservation for many reasons in addition to the fact that efficiency improvements save them money. These reasons include comfort, productivity enhancements, environmental concerns and so on. [Consumers will also adopt energy-efficiency measures that, if evaluated solely from their electricity benefits, are above the regional cost-effectiveness limit because these measures have significant non-energy value, such as comfort, productivity or product quality improvements. The Council has not attempted to estimate the size of this conservation resource, and it is not included in the estimates of cost-effective conservation discussed in this plan.]

How much conservation consumers will develop depends on how well the market for energy efficiency functions. One criterion for a well-functioning market is prices that accurately reflect the cost of the next increment of consumption. In the past, consumers' power rates were much lower than the marginal cost of electricity. In the more competitive environment, the price consumers pay for electricity will likely converge with the marginal cost of electricity supply. [We expect competition to result in a trend toward unbundling of electricity rates - separating the costs of the kilowatt-hours delivered from the fixed costs of delivering the electricity and lowering the price of the kilowatt-hours. Only through such unbundling can consumers compare their supply alternatives on an apples and apples basis. Lower prices and unbundling will reduce the disincentive utilities experience when conservation cuts into their recovery of fixed costs. It will also reduce the consumer's economic incentive to conserve.] If this occurs, then one of the two key elements of a functioning market will be in place; marginal prices will approximate marginal costs. [Marginal costs are unlikely to reflect all environmental costs of electricity production, so there will not be a completely accurate price signal.]

However, there is another, equally essential element of a functioning market: that buyers and sellers can make well-informed choices. Good information implies that: 1) the decision-maker has timely and accurate knowledge; and 2) the decision-maker has enough confidence in that knowledge to base decisions on it.

The lack of good information in electricity and conservation markets takes the following forms: low awareness of how energy and efficiency could be applied in homes and businesses; lack of adequate and quality information that gives the end-user a clear-cut, reliable course to follow; lack of access to capital and conflicting uses for capital; and a disconnect between the decision-maker contemplating efficiency choices and the consumer who pays the electricity bill. An example of this latter "split-incentive" problem is a home builder who builds a house on speculation and wants to minimize first cost, and the eventual homeowner who will ultimately pay the utility bill and has little understanding of long-term energy costs. The lack of good information in its various forms constitutes a barrier to the functioning of the market for energy efficiency.

There is an old joke about the economist who passes by a $20 bill on the sidewalk. When asked why he passed it by, he replied that it can't be a real $20 bill because somebody would already have found it and picked it up. Despite economic theory, the experience of the past 15 years of conservation implementation is full of examples of $20 bills left on the sidewalk and in homes, offices and factories because of market barriers. Market barriers make it unlikely that consumers will take advantage of all cost-effective energy-efficiency improvements.

An example is the fact that many consumers pass up opportunities to buy more efficient appliances, even when the energy saved by the more efficient appliances, evaluated at the consumers' cost of electricity, would offset the extra capital cost of the appliance in a matter of months. Interpreted as investment opportunities, these efficient appliances can be very attractive to consumers; they might return 30 percent to 50 percent or more on the initial investment. But relatively few consumers evaluate their purchases in those terms. Similar patterns of consumer choice show up in residential and commercial buildings and in the industrial sector.

Conservation Developed by the Competitive Market

There are certain types of activities that utilities and energy service companies are likely to pursue as the emerging industry structure becomes more apparent. ["Energy service companies" are companies that offer demand-side management services, including conservation. The term appears to be evolving, and is now used to denote companies that are interested in general energy services, including choice of fuels and load shifting.] Utilities and energy service companies are interested in providing consumer information to overcome the market barriers described above to the extent that it allows them to make a profit.

The types of products and services that will promote conservation and align with the business interests of utilities or energy service companies are those that promote customer loyalty and satisfaction, or that can be offered at a profit. In a competitive market, the cost of kilowatt-hours from different suppliers will vary only slightly. As a result, conservation services might be one tool in an arsenal of options to differentiate one supplier's product from another's and create customer loyalty.

Manufacturers of efficient products will also have an interest in promoting their products. For example, Honeywell wants commercial building managers to adopt Honeywell's energy management system. However, efficiency is usually just one feature in a whole host of features that consumers are searching for in a particular product. As a result, the market niche for efficient products is usually small, unless it is packaged with key additional features.

The common thread in these approaches to conservation is that they will increase the viability and/or profitability of the company providing the service by offering superior and/or differentiated products that are desired by customers. Mostly they are products or services that can be charged directly to the benefiting customer, and the customer values them enough to pay a price premium. These services cannot be supported by other customers, because the benefits do not accrue to all customers, but to the customer that directly installs the conservation. They are primarily market-driven efficiency services.

The following are the types of conservation services that are likely to be developed in a more competitive electricity market.

Customer retention services: Energy companies that want to build customer loyalty may help the customer find ways to reduce the cost of electricity use. For example, in an effort to retain their business, Puget Sound Power and Light recently included conservation services in a package to one of its larger customers who was investigating alternative power suppliers.

Enhanced services: Some energy companies may elect to offer services rather than energy sales (kilowatt-hours) to their customers. An example might be selling air compression to an industrial firm. Rather than charging for the electricity used to energize the air compressor, the energy service company would charge for the amount of compressed air used. In this situation, it is in the interest of the energy service company to produce the compressed air at the lowest possible cost. If the cost of improving efficiency is lower than the energy cost, they will have an incentive to improve efficiency.

Fees for expertise: Energy companies will sell their ability to help customers reduce their costs, increase their comfort and productivity, or both. The fee represents a sharing of the cost savings between the customer and the energy service company. For example, Western Montana Generation and Transmission Company is considering opportunities such as charging for audits of homes heated with electricity or natural gas.

Differentiation from competitor's products: Some energy providers may try to capture a market niche based on environmental or societal values. These companies will promote "green pricing" or the fact that they are a "green" company, offering energy-efficiency services to secure particular customers. Working Assets Long Distance is an example of this strategy in the telephone industry. A number of electric utilities around the nation, including Portland General Electric and Salem Electric in the Northwest, have tried various approaches to offering green services, with mixed success.

Efficient use of the distribution system: In either a competitive or regulated environment, it will make sense for utilities owning distribution systems to utilize those systems fully. This means reducing power losses on the distribution system itself, as well as load management and load reduction on customers' facilities that might otherwise require more costly system upgrades.

Community values: A number of utilities in the Northwest, particularly some of the public utilities, have offered conservation programs because their customers viewed it as the right thing to do. To the extent that the conservation ethic persists, some utilities will continue to pursue conservation that satisfies their customers.

Conservation Development Experiences in More Competitive Markets

The electricity industry in the Northwest is not the first to undergo major restructuring. The Council reviewed the experience in other countries and industries to assess the probability that conservation's apparent benefits to the region will be secured in a more competitive energy service market. This review revealed the following:

- Experience in all five countries where the electricity industry has been opened to competition shows that the acquisition of conservation tends to decrease in newly competitive markets, and that private conservation companies have not emerged as strongly or as quickly as predicted. [Lance Hoch and Linton Parker, "Sustainable Energy Policy in Competitive Electricity Markets: what's Been Tried, What Works and What Doesn't," Proceedings of the Fourth International Energy Efficiency & DSM Conference: The Global Challenge, Berlin, Germany, October 1995, pp. 503-511.]

- Experience from the U.S. gas industry, which has been deregulated for 10 years, indicates that niche markets have developed for conservation, but it has not been widespread.

- Very recent experience of a few energy service companies indicates that those that do not rely on shared savings and/or utility financial support, but instead provide a building with specific end-use services (e.g., lighting, space conditioning, etc.) for a fixed annual fee (with adjustments for inflation and weather) may successfully penetrate a limited market niche (e.g., large office buildings).

Conservation Program Evaluations and their Estimation of Market Effects

Evaluations of previously operated conservation programs are also a source of information on what the market might accomplish. In some of these evaluations, the utility tried to ascertain how much of the savings might have occurred in the market even without the utility program. [The evaluation community has used the term "free-rider" to denote the portion of participants in a utility program that would have done the conservation on their own. This is an estimate of what the market would have accomplished without the utility program.] For the Northwest, evaluations from the industrial sector provide the most information on what the market would have done without the program. The evaluations indicate that approximately 5 percent to 15 percent of the savings from various programs would have been done anyway, even without the utility's help. This indicates that without some sort of information, or financial help, or both, the market will achieve some, but not all, cost-effective conservation on its own.

Additional Opportunities for Conservation Development

The types of conservation that are most at risk of being bypassed in a competitive market are those that do not align with the business interest of a provider, such as an energy service company. Utilities and energy service companies may not have much business interest in intervening if the conservation resource is small and widely dispersed in thousands of facilities, and the profit margin to pursue each of these individually is small. For example, more efficient refrigerators save individual consumers about $4 per year. This is too little to overcome the high administrative costs of pursuing these savings on a customer-by-customer basis. However, if the savings can be achieved in the aggregate, for example, through the manufacturer, they are significant.

There are several types of conservation resources that may be difficult to secure in a competitive environment. These include:

- State energy codes

- Federal appliance efficiency standards

- Demonstration of emerging technologies and systems

- Market transformation efforts

- Instances in which the conservation decision is not made by the energy bill payer, such as rentals.

Options for Conservation Development in the Long-Term

Of the $2.3 billion in savings that can be expected if all cost-effective conservation is developed, approximately $1.7 billion falls into the category of savings that seem unlikely to be produced through near-term utility commitment or, in the long run, by a competitive electricity market. What follows is a discussion of alternative ways the Northwest can secure the remaining energy savings.

Give the Market a Chance

The Northwest could focus its efforts on developing more competitive electricity markets and wait to see what the effect is on conservation acquisition. Because many utilities still intend to pursue conservation development for various reasons, and some government programs also will garner energy savings, acquisition over the next three to four years is likely to be substantial.

New/Revised Mechanisms

The region could focus on activities that would encourage development of the most cost-effective conservation during the transition to a more competitive electricity market. This might include providing appropriate regulatory signals for existing investor-owned utilities and focusing on resources that might be lost during the transition from the current regulatory compact to any new market. Potential forms of new and revised mechanisms might include the following:

Require conservation as a "public good" in exchange for a monopoly franchise at the distribution level: Even in a competitive electricity market, distribution companies are likely to remain monopolies. They will have no incentive to pursue conservation as a least-cost resource. However, if regulators for investor-owned utilities, and the public for public utilities, think that conservation has benefits that should not be lost, then some level of conservation services on the part of the distribution company might be required in exchange for the monopoly franchise. To make this work, the distribution company should have its profits disconnected from its sales of kilowatt-hours.

System benefits charge: A frequently discussed option to raise funds for conservation resources that might not be captured by the open market is a "system benefits charge." The system benefits charge is a fee assessed broadly across the electricity system that is non-bypassable and is used to develop conservation. Exactly how these funds are raised and how they would be spent would need to be fully explored. [For example, PacifiCorp has initiated a discussion on how to develop conservation in the more competitive world, which looks into exactly these questions. Two white papers have been developed by PacifiCorp to aid in the discussion.] The idea, however, is similar to the levy on phone bills to provide 911 emergency calling and universal service for low-income and physically impaired customers. Almost every active restructuring process in the United States is calling for a system benefits charge or something very similar to maintain some level of energy-efficiency services. The same is true of many international restructuring decisions, such as those in the United Kingdom, Norway and New Zealand.

Conservation as part of meeting load growth or developing new generating resources: Another option that might be used to encourage conservation development would be a requirement that a certain percentage of load growth be met through conservation efforts. Investments beyond the required offset could be banked or sold on an open market. Utilities, generation resource developers and others could obtain, bank and sell conservation offsets. The system would be similar to the market developed around sulfur-dioxide emissions.

Recommendation

Council analysis indicates that there is a substantial amount of cost-effective conservation available for acquisition in the region. Approximately 20 to 30 percent of this conservation will likely be acquired in the restructured electricity industry through market forces and momentum from existing utility action. If the remaining 70 to 80 percent of the savings are not acquired, the result would be higher power system costs than would be the case if the total amount of cost-effective conservation was acquired.

In the regulated utility paradigm, mechanisms to acquire conservation were available that resulted in relatively little disruption of the market. The new utility structure, especially in generation and supply markets, is much more competitive. Competitive markets are sensitive to factors such as cross subsidies or incorrect price signals and will tend to exploit these factors where they occur.

The Council suggests that the Comprehensive Review and appropriate state forums evaluate the costs and benefits of potential mechanisms to acquire conservation beyond what will be developed in the market. The goal should be a competitive market that preserves as much of the net conservation benefit as possible.

These mechanisms should reflect the principles outlined below.

- Any intervention should be competitively neutral, and not give one electricity or other energy resource provider an advantage relative to another. Intervention should not interfere with the market pricing of electricity and the operation of a competitive electricity market. For example, use of a non-bypassable charge on distribution minimizes the ability for competitive electricity suppliers to avoid the charge. At the same time, the magnitude of the charge must not upset the competitive balance between electricity and natural gas or other fuel suppliers.

- Any intervention should complement the competitive market for energy services that might emerge. This might include a strategy for those types of conservation actions that need a kick-start, but that can eventually be handed over to the competitive market. In this case, the strategy should include signals for when to cease the intervention.

- Any intervention should provide some symmetry between those who pay for the intervention and those who receive its benefits.

- Any intervention should be administratively efficient to gain the greatest net benefits possible.

- Any intervention should use competitive mechanisms to the greatest extent possible when acting to secure the conservation resource.

- Any intervention should incorporate performance assurance mechanisms to secure the savings.

|

Conservation: What to Do Now During the transition to more competitive electricity markets, the Council has identified 10 things utilities, regulators, end-users, governments and the conservation industry can do to help maximize conservation benefits, minimize conservation costs and smooth the transition.

|

6-B. A Renewable Energy Strategy

An objective of the Northwest Power Act is "to encourage the development of renewable energy resources within the Pacific Northwest." Renewable resource-based generating projects producing more than 420 average megawatts of energy have been developed since adoption of the 1991 Power Plan. This represents about 17 percent of all resources developed during this period. Encouraging progress has also been made on the renewable resource confirmation agenda set forth in the 1991 Power Plan. However, declining wholesale electric energy prices have resulted in near-cessation of additional generating resource development, and few new renewable projects are expected to be cost-effective in the near-term. This is consistent with the surplus of generating capacity on the Western electrical system, but raises the question of what type and level of renewables activity, if any, is desirable in this environment.

In developing this draft plan, the Council has assessed the value of the renewable resources available for development in the Northwest. This analysis considered load growth, hydropower and fossil fuel price uncertainties in an attempt to capture the resource diversity benefits of renewables. The analysis also considered the possibility of a carbon tax, should aggressive measures to reduce greenhouse gas production be needed. The values of several accelerated renewable resource development strategies, including sustained development, were also assessed and compared to developing renewables only as they become needed and cost-effective.

Based on its analysis, the Council has concluded that few renewable resources are cost-effective in the near-term. Unless carbon dioxide control measures increase the cost of other resources, the large inventory of undeveloped renewable resources available to the Northwest has little expected economic value if current forecasts of technology cost and performance, fuel price, water availability and load growth uncertainties hold. However, the potential value of renewable resources increases substantially if mitigation of carbon dioxide production is required to control global climate change.

A possible strategy of maintaining a set level of sustained renewables development was also analyzed. This analysis also suggests that there is little economic value in a strategy of sustained development of renewables. Projects developed in advance of cost-effectiveness would require a substantial cost premium, they would preclude the benefits of later technological development, and they are unlikely to produce significant economic benefit. This finding holds with consideration of fuel price, water availability and load growth uncertainties and with adoption of relatively high carbon taxes.

Nonetheless, because of the potential value of renewables in the event of control measures on carbon emissions, it is important to improve our understanding of the region's renewable resource potential and to ensure that the better resource areas remain available for development, if needed.

These findings suggest that a renewables strategy for the Northwest should focus on:

- Ensuring that the restructured electric power industry provides equitable opportunities for the development of cost-effective renewable projects;

- Ensuring that the renewable resource potential of the Northwest is adequately defined and that prime undeveloped renewable resources remain available for possible future development. This will require completion of key demonstration projects and resource assessment studies already under way;

- Supporting research and development efforts to improve renewable technology;

- Offering green power purchase opportunities; and

- Monitoring fuel prices, the global climate change issue and other factors that might influence the value of renewable resources. More aggressive preparation for the development of renewables could be initiated if changes in these factors indicate that accelerated development of renewables is desirable.

|

The chief arguments that have been advanced by supporters of renewable resource development include: Favorable environmental characteristics: Long-term and broadly dispersed environmental impacts, such as those linked to nuclear waste disposal, fossil-fuel extraction or atmospheric pollutants, are rare with renewable resources. In many cases, the environmental effects of renewable energy development are limited to the vicinity of the project and are relatively manageable. Improved air quality and few greenhouse gas emissions: Wind, solar and hydropower resources have no atmospheric emissions and contribute no greenhouse gases to the atmosphere. Geothermal plants release comparable or fewer atmospheric pollutants and much less carbon dioxide than fossil-fuel combustion. Biomass combustion releases more pollution than natural gas for generation of an equivalent amount of power. However, controlled burning of biomass residues for power generation is less polluting than the uncontrolled burning of these materials that might otherwise occur, and the carbon dioxide released by combustion of biomass will eventually recycle if sustainable forestry and agricultural practices are followed. Energy cost stability: A diverse resource portfolio, including renewable resources, offers resiliency against fuel price, technology and environmental risks and uncertainties. Local economic benefits: Renewables development can provide long-term employment, royalty and tax benefits to local communities that may not otherwise benefit from power system investments. Regional self-sufficiency: Indigenous renewable resources reduce the need for energy imports and provide protection from fuel or transmission interruptions. Development of products for export: An active domestic renewables industry can create products and services for overseas markets. Non-power direct benefits: Some renewable energy projects, such as landfill gas energy recovery, offer important non-power benefits. Promote a sustainable energy supply: A sustainable society is one in which humans can thrive without progressively degrading the natural environment and for which the living standards of future generations are not diminished by actions of the present. Renewable energy resources appear to constitute an important component of a sustainable energy supply. Public support: Although the development of specific renewables projects may be locally controversial, renewables in general enjoy broad public support. |

Renewables Activities - 1991 to the Present

About 700 to 800 megawatts of renewable resources, primarily hydropower and biomass cogeneration, were identified by the Council in the 1991 Power Plan as potentially cost-effective for development during the 10-year period following adoption of that plan. That plan called for development of these low-cost renewable resources. Since that plan was adopted, renewable projects providing more than 420 average megawatts of energy have been developed, and additional projects remain to be completed. Hydropower and projects using biomass residue fuels provide the bulk of this energy.

Recognizing that the cost of most renewables, though declining, was still higher than alternatives, the Council in its 1991 plan recommended a renewable resource confirmation agenda. The confirmation agenda is a set of coordinated research, development and demonstration activities intended to foster the efficient development of geothermal, solar and wind resources at sites in the Northwest. Confirmation activities include resource assessment, resolution of development constraints and renewable demonstration and pilot projects. These are described in Appendix K.

Many of the confirmation agenda actions have been initiated, though few have been completed. Most successful have been long-term wind and solar resource assessment, geothermal and wind pilot projects, and niche applications of solar photovoltaics. Less progress has been made on actions intended to secure improved resource information at specific sites, with the exception of environmental assessment at sites proposed for demonstration or pilot projects, and solar resource monitoring.

Prospects for Development of Renewable Energy Resources

As discussed in Chapter 5, technology improvements and production economies are expected to continue to reduce the cost of electricity from renewable resources. However, because of declining gas prices and continuing improvement in gas turbine technology, energy from most renewable resources is expected to be more expensive than new gas-fired combined-cycle power plants over the near term. Moreover, most renewables require large capital investments, which must be amortized over a lengthy operating period in order to secure competitive power costs. This is a disadvantage in the currently uncertain and changing utility industry where financial flexibility and minimal long-term capital investment are prized. The intermittent energy production of some renewables further reduces the value of their energy, and may increase the cost of delivering power from remote renewable resources because of the resulting low transmission capacity factor. Finally, though renewables (biomass excepted) are free of fuel price risk, they are susceptible to technology performance risk; the generating equipment must operate reliably over a long lifetime to recover the initial capital investment.

Given these economic handicaps, and absent major shifts in resource economics, such as would result from unexpectedly rapid increases in natural gas prices or adoption of carbon dioxide control measures, few renewable resources are likely to be cost-effective in the near term. Exceptions might include hydropower upgrades, upgraded chemical recovery cogeneration at pulp mills and projects developed primarily for non-power benefits (such as generation using landfill gas).

In the longer term, technology development is expected to improve the competitive position of some renewable resources. Costs should continue to decline for currently immature technologies, such as gasification of solid biofuels; technologies that stand to further benefit from economies of production, such as photovoltaics; and technologies that may benefit indirectly from research and development in other industries, such as geothermal exploration and drilling. The performance of fossil-fuel technologies is also expected to improve, but the effects of these improvements may be offset by escalating gas prices.

Value of Renewables Available for Development

Though few renewables are cost-effective in the near-term, having renewable resources available for development, in case they are needed, may have appreciable economic value. Considering only the uncertainties of water availability, load growth and fossil fuel prices, the expected value of renewables likely to become cost-effective over the 1996 to 2015 period is $28 million. This is compared to a present-value system cost of approximately $26 billion. The range of possible outcomes resulting from water availability, load growth and fossil fuel price uncertainty is not large.

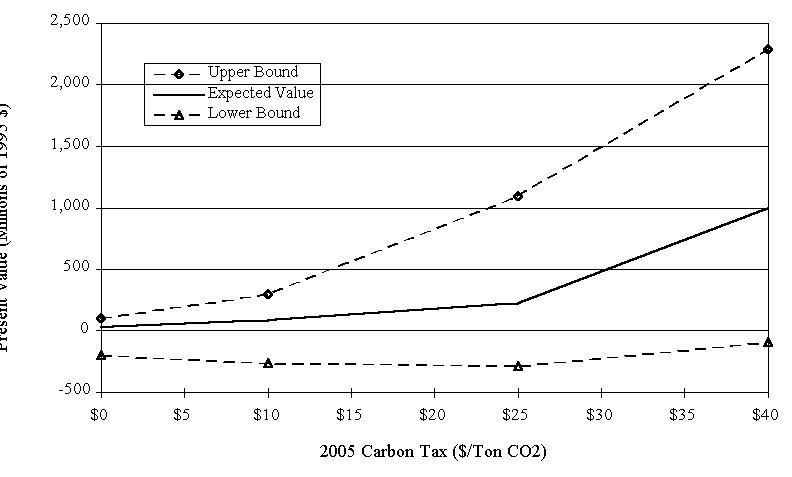

The prospect of greenhouse gas control measures greatly increases the amount and value of cost-effective renewable resources. In this analysis, a carbon tax is used as a proxy for greenhouse gas controls. The tax rate range of $10 to $40 per ton of carbon dioxide emitted that is assumed for this analysis is consistent with fuel tax rates thought to be necessary to induce significant reductions in carbon dioxide production. This analysis assumes that a firm schedule for implementing a carbon tax is agreed to in 2000, and the tax is assessed beginning in 2005. This would provide time to initiate development of carbon dioxide offsets, conservation and renewable resources, and otherwise prepare for the tax. This approach is consistent with the phasing approach for pollutant reduction used in the Clean Air Act amendments of 1990.

The increase in the net-present value of the renewable resource inventory for the range of possible carbon tax levels is shown in Figure 6-6. As expected, carbon taxes result in more, and earlier, development of conservation and renewables. Electrical production cost savings occur by meeting new loads with resources that don't release carbon dioxide and by displacing the operation of existing projects that are sensitive to carbon taxation, such as coal-fired power plants. The expected net-present value of the renewables inventory increases to $86 million, $226 million and $997 million with carbon tax levels of $10, $25 and $40 per ton of carbon dioxide, respectively.

Figure 6-6. Net Present Value of Renewables Available for Development

Value of Accelerated Renewables Development

Because the societal benefits put forth by supporters of renewables development (see Box) are not necessarily incorporated in market-based resource decision-making, the level of renewables development that will be achieved purely on the basis of market prices may be less than the level that would occur if all societal values were considered. Some have argued that the gap between market-driven renewables development and this "societally optimal" level could be closed by establishing a target rate of renewable resource development. Market-driven levels of renewable resource development could be accelerated using resource portfolio standards or system benefit charges.

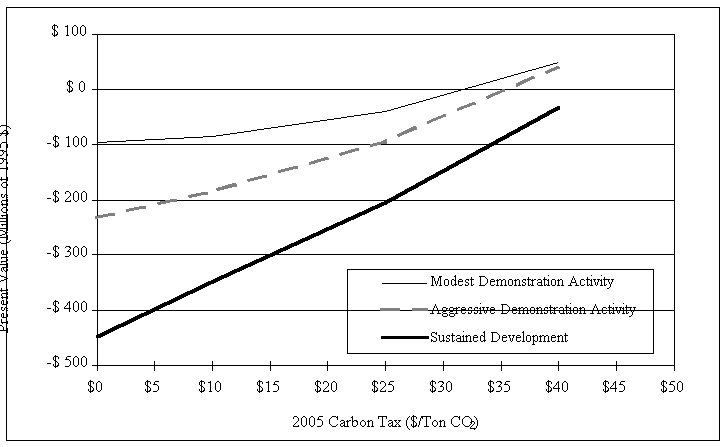

To assess the value of accelerated renewables development, three levels of developing renewable resources in advance of their need or cost-effectiveness were analyzed:

- Development of 27 average megawatts of renewable energy in advance of need and cost-effectiveness over the period 1999 to 2004. For the analysis, one 30-megawatt geothermal project was assumed to be developed. This level of project development is representative of a modest extension to the current renewables pilot and demonstration program.

- Development of 89 average megawatts of renewable energy in advance of need and cost-effectiveness over the period 1999 to 2004. For the analysis, two 30-megawatt geothermal projects and two 30-megawatt wind plants were assumed to be developed during the period. This level of project development is representative of an aggressive renewables pilot and demonstration program.

- Development of approximately 30 average megawatts of renewable energy per year in advance of need and cost-effectiveness between 1999 to 2004 for a total of 129 average megawatts. For purposes of the analysis, a mix of biomass, geothermal, solar and wind resources was assumed to be developed, including (relatively) low-cost projects that are added to sites already having pilot projects and pilot development at new areas. This rate of development would be representative of moderate-level sustained renewables development.

As in the previous analysis, an attempt was made to incorporate the societal benefits of renewables that may not be reflected in the resource decisions of a competitive wholesale electricity market. In addition to the energy contribution, much of the diversity value of renewables was included by considering hydropower, load growth and fossil-fuel price uncertainty. Fuel carbon tax cases of $0, $10, $25 and $40 per ton of carbon dioxide, levied as described above, help set a value for the carbon-free characteristics of renewables. Accelerated development was assumed to shorten lead times for subsequent development of additional projects at sites that have significant resource potential and to accelerate geothermal cost reductions. [Because of the site-specific characteristics of geothermal resources, advanced development at Northwest sites could accelerate cost reduction for subsequent geothermal development beyond the rates illustrated in Figure 5-8. The levels of accelerated development considered in this analysis would be unlikely to stimulate reductions in biomass, wind and solar photovoltaics beyond the rates shown in Figure 5-8.] Projects were assumed to accumulate credit for carbon offsets between 2000 and 2005.

The analysis does not reflect possible costs or benefits of non-carbon environmental effects, economic development issues, non-power direct benefits or contribution to a long-term sustainable energy supply. These effects appear to be generally offsetting (e.g., the local environmental effects of renewables development versus the residual air-quality impacts of fossil-fuel development); subject to non-energy policy (e.g., economic self-sufficiency); or do not appear to be compromised by any of the courses of action considered (e.g., long-term energy sustainability).

Figure 6-7. Net Present Value of Accelerated Renewables Development

As illustrated in Figure 6-7, the expected net present values of the three levels of accelerated renewable development are negative except for the cases of high carbon taxes. The moderate and aggressive pilot and demonstration programs result in positive net present value for carbon taxes between $30 and $40 per ton, or greater. The net present value of the five-year sustained development program is negative across the full range of carbon taxes examined.

The generally negative expected values of accelerated renewables development result from: 1) the development and operating costs of the renewables are high compared to other alternatives during the period of accelerated renewables development; 2) early development of prime resource areas precludes later development of these sites using improved and less-costly technology; 3) the value of pilot projects in reducing the lead time for subsequent step-out development has been reduced by the availability of surplus power on the wholesale market and by the assumption that the coming of a carbon tax will be known several years in advance. Advance notice of a forthcoming carbon tax would provide time for aggressive efforts to prepare promising large renewable resource areas for development.

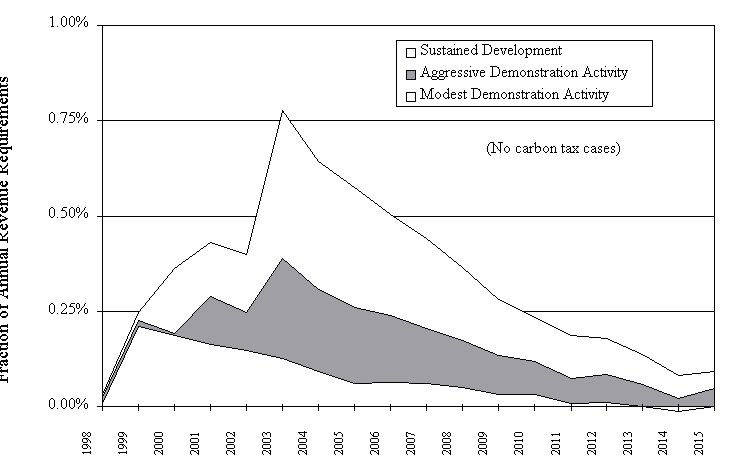

Figure 6-8. Impact of Accelerated Renewables Development on Revenue Requirements

The effect of accelerated renewables development on annual regional electricity revenue requirements was also assessed. (See Figure 6-8.) The results are roughly indicative of the impact on rates, assuming that the net costs are evenly spread on the basis of energy consumption. Costs of the current renewables confirmation activities are excluded.

By the fourth year (2003), the net cost of the five-year sustained development program peaks at 0.78 percent of regional revenue requirements ($71 million). In following years, net costs decline because of the combined effects of load growth (which increases regional revenue requirements) and the increasing cost of wholesale power and combined-cycle resources (because of fossil fuel price escalation and the cost of complying with increasingly stringent California nitrogen oxide control requirements). Over the 10-year period 1996 through 2005, net costs of the 2000 to 2004 sustained-development program average about $31 million annually.

The other two development strategies are less costly. By the fourth year (2003), the net cost of the five-year aggressive pilot and demonstration program peaks at 0.39 percent of regional revenue requirements (about $36 million). The modest pilot and demonstration program peaks at 0.21 percent of regional revenue requirements (about $21 million) in its first year. Over the 10-year period 1996 through 2005, the annual net costs of aggressive and modest pilot and demonstration programs average about $18 and $9 million, respectively.

Because the resource costs used to model accelerated development were representative of adding new projects to existing sites and not pilot project development, actual costs would likely be somewhat higher than shown here.

Findings Regarding a Near-Term Strategy

The analyses described above lead to the following findings regarding a near-term renewable resource strategy:

First, the inventory of undeveloped Northwest renewable resources has little quantifiable potential economic value unless carbon dioxide controls are eventually required. However, the expected value of these resources increases from $86 million to $1 billion across a range of possible carbon taxes (see Figure 6-6).

Second, the development of renewable resources in advance of need and cost-effectiveness has little quantifiable economic benefit except in high carbon-tax cases. This results from the relatively high cost of most renewable resources and the following:

- The benefits of pilot projects in shortening the lead time for project development appear to be less valuable than in the past. The flexibility of the wholesale market, and the likelihood that greenhouse gas control measures, if adopted, would be phased in over a period of several years erode the benefits of shortened lead time.

- Near-term development of renewable resources foregoes the benefit of expected longer-term technology improvements for the resources developed. This effect is significant for renewables because of the limited supply of prime resources, the capital intensity of most renewables development and the expectation of relatively rapid technology improvements.

Third, the net cost of sustained development of renewables in advance of need would quickly approach 1 percent of regional electricity revenue requirements. The annual cost of a sustained development program would then decline if further acquisitions were terminated, and decline more rapidly if a carbon tax were adopted. The net cost of renewable development rates in excess of about 30 average megawatts per year or continuing for more than about five years would exceed 1 percent of revenue requirements. A modest five-year renewables research and development program consisting of, for example, a 30-megawatt demonstration project and slight expansion of resource assessment projects would require less than 0.25 percent of regional revenue. These figures exclude the net costs of the renewable confirmation activities that are under way.

Finally, continued technology development will improve the position of renewables. But, geothermal excepted, it seems unlikely that renewable development efforts by the Northwest could contribute significantly to the advancement of renewable resource technologies or the viability of renewable resource companies. A robust global market and public support for basic research and development are probably necessary to ensure that technology development continues and that equipment vendors and developers remain in business. In the case of geothermal, development efforts at Northwest sites might accelerate the optimization of technologies for these applications.

Conclusions: Justifiable Elements of a Renewable Resource Strategy

The findings described above suggest that the actions described below might be justifiable elements of a near-term (5 to 10 year) renewable resource strategy.

Ensure that the restructured electric power industry provides equitable opportunities for development of cost-effective renewable projects: Open access transmission at comparable rates, for example, will provide equitable opportunities for remotely situated renewable projects to access markets. Better understanding of the cost of transmission and distribution to specific loads will reveal the system benefits that might be provided by projects including remote solar photovoltaic applications.

Ensure that the renewable resource potential of the Northwest is adequately defined and that prime undeveloped renewable resources remain available for possible future development. This will require completion of key demonstration projects and additional resource assessment activities already under way: Continuation and completion of the resource assessment and demonstration activities of the renewable resource confirmation agenda of the 1991 Power Plan will provide much needed information. These activities, fully described in Appendix K, include completion, operation and monitoring of geothermal projects at Newberry Volcano, in Oregon, and Glass Mountain, in Northern California, and commercial-scale wind demonstration projects. Also included are long-term wind and solar resource monitoring, and further characterization of prime wind and solar resource areas. These projects are revealing the feasibility, cost and environmental implications of developing the geothermal, solar and wind resources of the Northwest, thereby providing guidance for management and future development of the best resource sites.

Support research and development efforts to improve renewable resource technology: While renewable resources my not be cost-competitive today, they are likely to be needed in the long-term, and further research and development will bring their costs down. Unfortunately, with a weak near-term market for renewables, research and development may be limited. Consequently, the region should make a special effort to support these activities. One approach might be to continue support for research and development at the national level, for example, through the activities of the Electric Power Research Institute. Research and development support should also extend to demonstration of new technology applications for renewable resources of regional importance, such as improved hydropower efficiencies and distributed solar applications.

Offer green power purchase opportunities: "Green power" [The term "green power" is commonly used to describe a wholesale or retail power product consisting of power from renewable sources.] purchase opportunities are of value to consumers who believe that the benefits of renewable resources are not fully reflected in market-driven resource development decisions. Green power sales will also foster markets for renewable technologies and maintain renewables development capability. Project development serving green power sales should focus on cost-effective renewables, to the extent that these are available, and additional projects at existing sites with the potential of synergistically improving the economics of both existing pilot projects and the added projects.