Previewing the Ninth Power Plan: Key milestones, analysis, and upcoming decisions

Work will occur throughout 2025 and 2026, with public meetings to be held in Idaho, Oregon, Washington, and Montana

- February 21, 2025

- Peter Jensen

The next two years represent a critical juncture for planning for the future course of the Pacific Northwest’s power system.

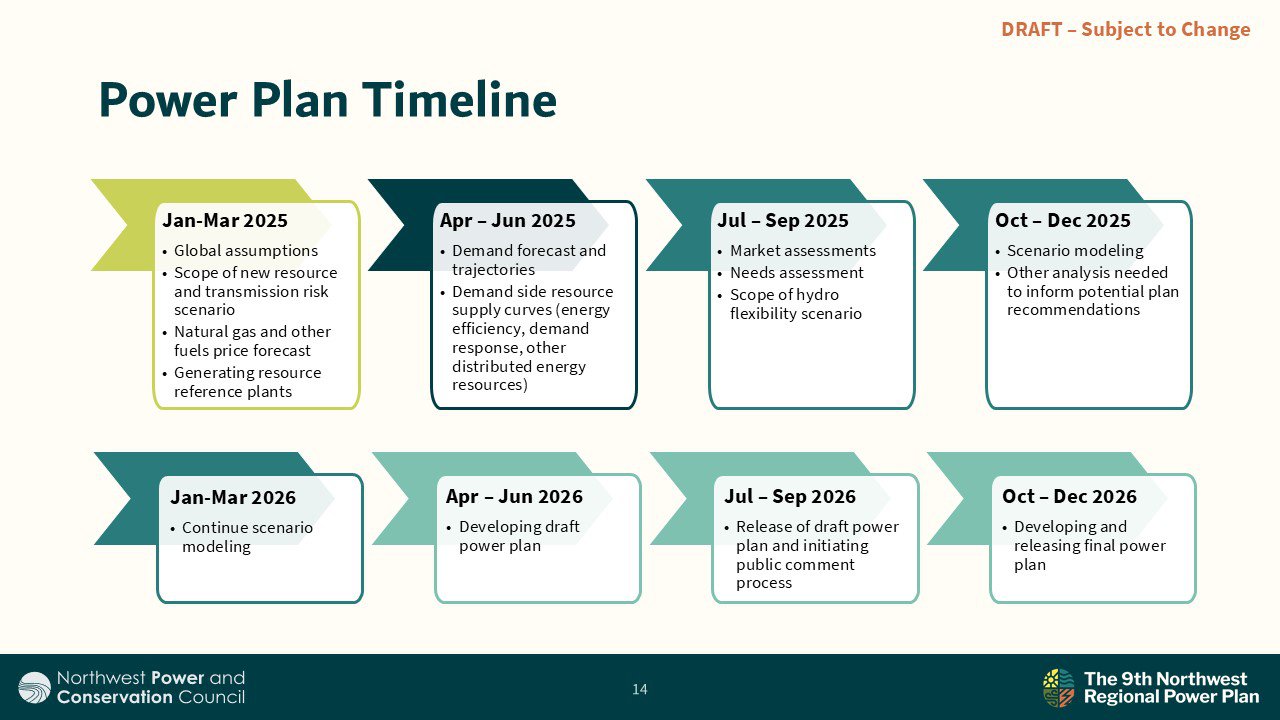

At February’s Council meeting, Power Planning Director Jennifer Light explained how the Power Division staff are approaching their analysis for developing the Ninth Northwest Power Plan. She reviewed key scenarios, points of uncertainty, as well as modeling assumptions, and provided a preview of how this process will unfold throughout 2025 and 2026 (Read presentation | watch video).

When it passed the Power Act in 1980, Congress could not have foreseen 2025’s circumstances. However, the Council’s regional power planning under the Power Act is well-suited to navigate a moment like this and prescribe the cost-effective resource strategy that will ensure the Northwest’s power system continues to be adequate, efficient, economical, and reliable. The Power Act has a second critical mandate to protect, mitigate, and enhance fish and wildlife impacted by the hydropower system in the Columbia Basin. Congress’ third charge to the Council is to do its work openly, transparently, and with extensive opportunities for public engagement throughout its four-state region of Washington, Oregon, Idaho, and Montana.

While staff will have to lock down some early elements of analysis to proceed deeper into planning, these could be revisited if needed. Nothing is cemented until the final Power Plan is adopted, likely by the end of 2026.

Load forecasting

Per the Power Act, one of the key elements to include in a power plan is a 20-year forecast of electricity demand. Electricity demand is growing in the Pacific Northwest, and especially so for electric vehicles, air conditioning, data centers, chip fabrication facilities, and other electrification to meet state goals and policies.

Upcoming milestone: In March and April, Power Division staff will present updated load forecasts looking across all sectors. Since 1980, the Council has approached load forecasting by analyzing sectors holistically, regionally, and over 20-year time spans. The forecasts consider several possible trajectories, which capture and reflect a range of future uncertainties for how much electricity demand materializes on the Northwest’s power system, and by when. This range of uncertainty is core to planning for the future and will be captured in every element of scenario analysis moving forward.

Generating resource options

The Council’s power plans identify new resources needed to meet energy demand in the coming years. The Power Act defines a resource as the actual or planned electric capability of generating facilities, or actual or planned load reduction from a renewable resource by a consumer, or from an efficiency measure.

For generating resources, the Council develops reference plants, which spell out resource characteristics like estimates of typical costs, logistics, and operating specifications. Council Resource Policy Analyst Annika Roberts presented on this topic at the February meeting (read presentation | watch video). For the Ninth Plan, staff is proposing solar, onshore wind, natural gas, battery storage, and renewables + storage, as well as some limited availability resources such as conventional geothermal, offshore wind, and pumped storage.

For emerging technologies, staff is developing “proxy” plants meant to represent resources with different characteristics, including a clean baseload resource, clean peaker/medium duration storage resource, and a long-duration storage resource. This proxy plant approach helps the Council evaluate and understand regional needs without being overly prescriptive of emerging technologies whose costs and timelines to commercial viability are uncertain. All of these reference plants, along with demand side resources like energy efficiency, become options for the models to consider when exploring how best to meet future energy demand.

Upcoming milestone: At the March meeting, the Council will define the specific characteristics of each reference resource and how they fit into modeling.

Demand side resources

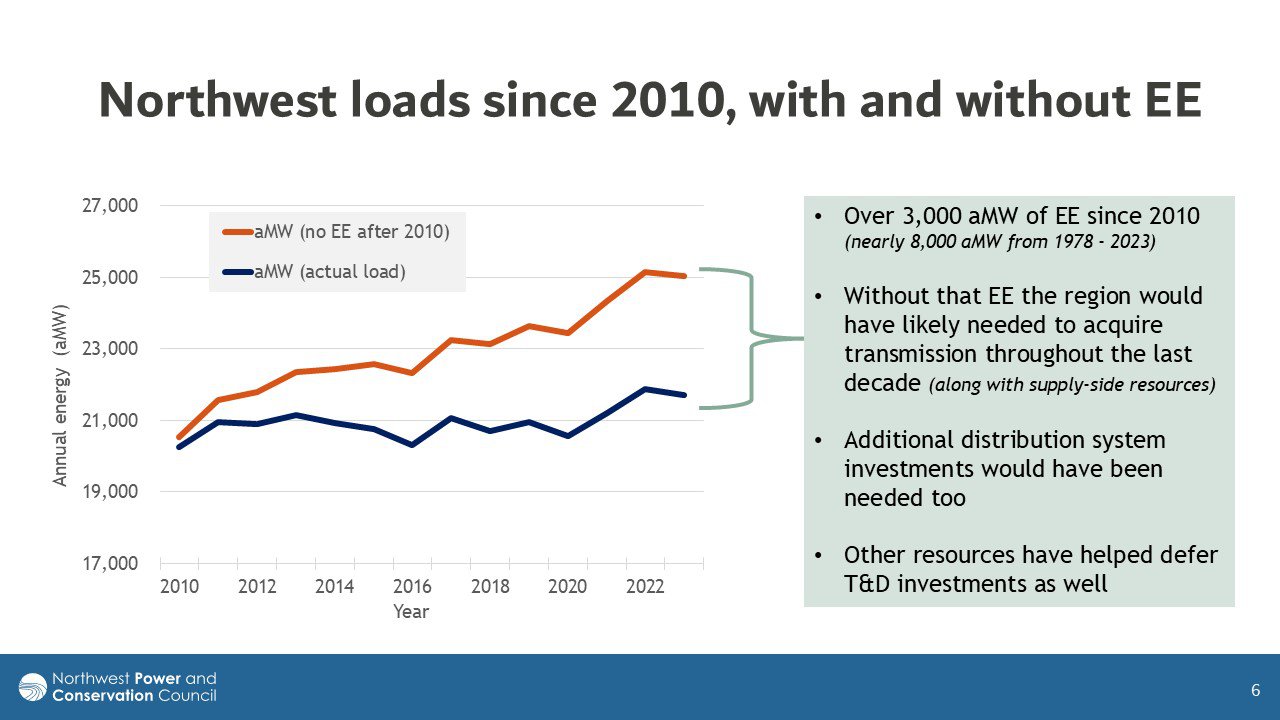

The Power Act requires that the Council prioritize cost-effective conservation when developing a resource strategy for the region. Since 1980, energy efficiency has been the cornerstone of the Council’s power plans. Accordingly, over the past 45 years the Northwest has acquired almost 8,000 aMW of cost-effective efficiency. Demand response is also providing benefit to the Northwest’s grid by improving reliability, making loads flexible during peak times, and reducing need to build new power plants. Distributed resources like behind-the-meter solar are also increasing in the Pacific Northwest.

Upcoming milestone: Between April and June, the Council will bring components of supply curves that inform the potential of and the estimated costs for efficiency, demand response, and distributed resources in the Ninth Plan.

Fuels price forecasts

Some power plants that help meet demand in the Northwest depend on fuels like natural gas and coal. At February’s meeting, Power Division Analyst Tomás Morrissey presented an updated forecast for the price of natural gas and coal (read presentation | watch video). Natural gas has been a growing resource in the Pacific Northwest; it produced roughly 1,500 aMW of electricity in 2002, and almost 5,500 aMW in 2023. The region has over 9,000 aMW of nameplate gas capacity.

The Ninth Plan’s proposed natural gas price forecast is based on several sources, including Northwest utilities, the Energy Information Administration, as well as regional and national trading hubs and commodities indexes. The median forecast is roughly $3/MMBtu in 2025 to $5/MMBtu in 2040 (2024 dollars). The Council uses a range of gas prices, and accounts for variability in prices from potential periodic price spikes. Coal prices are expected to be largely flat in Montana and Wyoming at $2/MMBtu from 2025-2040; and remain slightly above $3/MMBtu in Nevada over that timeframe.

Market buildout

The Northwest is part of a broader electricity network called the Western Electricity Coordinating Council that spans from British Columbia and Alberta, Canada, across 14 Western U.S. states, and a portion of Baja Mexico. Understanding the loads and resources across the WECC can inform the depth and cost of market resources.

Upcoming milestone: Staff will produce market availability assessments examining forecasted build-out across the WECC territory between July-September 2025.

Extreme weather and wildfire risk

Extreme weather like heatwaves and winter storms are pushing seasonal peak energy demands to new record highs, while at the same time threatening reliability by disrupting supplies and critical infrastructure.

Over the past year, Power Division staff have been working with the Climate and Weather Advisory Committee to ensure that the Council is appropriately representing climate change data and extreme weather data in modeling, capturing both multi-day events with extreme heat and cold in the Pacific Northwest. Staff has also been working to model operational risks from wildfires, which impact the power system, may pose adequacy challenges, and could influence new resource decisions.

Upcoming milestone: On March 7, staff will host a webinar discussing how they are preparing to capture the operational risk of transmission derating, smoke-induced reduction of solar generation capacity factors, and considerations of the location value of resources due to smoke cover. By embedding the operational risk of wildfires in the modeling and data, staff aims to have “wildfire-informed” planning for the Ninth Plan.

In January, Power System Analysts Daniel Hua and Dor Hirsh Bar Gai led a presentation about how they’re incorporating extreme weather in climate change data (watch video).

In October, Hua provided an overview of the climate change data to be used in load and resource modeling (watch video).

Resource adequacy and assessing needs

Following an extensive public process working with the region, the Council recently upgraded its standards for resource adequacy to better protect the Northwest power system. The Council now uses a multi-metric approach that helps identify the magnitude, scope, and duration of adequacy events. This is a major advancement in understanding the extent of potential challenges and then prescribing the correct solutions.

Upcoming milestone: In April, the Council will consider the Ninth Plan’s proposed resource adequacy metrics and thresholds.

One of the key parts of the early power planning work is developing the needs assessment. This is similar to the Council’s annual studies of resource adequacy. It analyzes the grid’s existing resources and what the needs are based on forecasted load growth. The adequacy metrics inform the scope and magnitude of future power system needs, which the Ninth Plan will then be able to solve. As staff go deeper into the process of developing the Ninth Plan, they’ll test resource strategies and use modeling to produce possible build-outs of the power system. They’ll be testing to ensure those meet the adequacy metrics. Staff will also ensure that the final recommended cost-effective strategy meets each one of these adequacy thresholds.

Upcoming milestone: Staff will be developing the needs assessments for the various sensitivities between June-September 2025.

Ninth Power Plan scenario modeling

The Council handles planning under uncertainty in multiple ways. For demand forecast, weather, and gas prices, the Council assumes a range of futures across all modeling to explore uncertainty and variability.

For other elements, the Council uses scenario modeling to explore how changes in key assumptions impact the modeled resource build for the Northwest. Much of the scenario modeling will take place between fall of 2025 and spring of 2026. At February’s meeting, Light explained more about the proposed scenarios that the Power Division staff will be testing and then discussing results with advisory committees and the Council.

There are two priority scenarios covering resource and transmission risk as well as hydro operations flexibility.

Resource and transmission risk

This will explore uncertainty around resource availability, resource costs, and transmission availability. It will analyze six sensitivities:

- Constrained new resource and transmission options: Exploring resource selection in a world with limited new transmission and significantly delayed/limited emerging tech resources

- Evolving federal policy landscape: Exploring implications of increasing cost on supply side resources (changes to tax credits, tariffs) and some near-term delays in resource availability due to ongoing supply chain challenges

- Changing transmission availability: Exploring changes in resource selection with more transmission availability (potentially two looks)

- Changing emerging tech resource assumptions: Exploring which resource solutions emerge based on differing assumptions on emerging tech resource costs (increase and decrease) and delayed availability

- Limited short-duration storage availability: Exploring resource selection in a world where short-duration storage is limited in the near-term

- Slower demand side resource availability: Exploring resource selection if demand side resources have reduced availability

The regional transmission system has bottlenecks and constraints at key points, while some projects to expand the system will require lengthy amounts of time to plan and construct. While the Council does not do transmission system planning, transmission availability and capacity are an increasingly important element to the Council’s power planning. The Council plans to rely on the analysis of the Western Transmission Expansion Coalition to inform potential transmission availability. The WestTEC is an industry-led initiative that convenes states, BPA, utilities, tribes, public interest groups, energy providers, and transmission companies, among others.

The coalition will produce a study looking out over 10- and 20-year time periods. This will include detailed descriptions of required infrastructure, including locations, technologies, and upgrades; comprehensive cost estimates and assessments of benefits for the Western region; preliminary routing options to support permitting, siting, and construction feasibility studies; and transmission alternative review, highlighting trade-offs and reasons for selecting preferred options. The Council plans to leverage these results to inform different transmission build out looks in its scenario modeling.

Hydro operations flexibility

This scenario analyzes implications for resource needs depending on the flexibility of the hydro system.

The Northwest’s largest generating resource remains the Columbia River hydropower system, whose output can vary widely depending on annual climate, precipitation, and snowpack. That system must also balance needs for power generation with the need to reliably implement river operations for flood risk management, transportation, agriculture, as well as fish and wildlife.

The 2021 Power Plan identified a need for power system flexibility to support the integration of renewables. As renewable energy build-out increases in the Northwest, operational flexibility will continue to be a priority. The 2021 Plan showed that the hydro system could provide part of that flexibility; however, that would also result in river flows that might negatively impact fish and wildlife. The Ninth Power Plan will include scenario analysis exploring changes to hydropower flexibility.

Recommendations in the Council’s upcoming Fish and Wildlife Program amendment will help the Power Division staff determine which sensitivities to explore. Recommendations are due by April 17.

All of the Council’s monthly meetings and meetings of our eight advisory committees are open to the public, so please check this website, the Spotlight newsletter, and social media channels for notices on upcoming meeting dates, times, and agendas.

In 2025, the Council will be hosting its monthly meetings:

- March 11-12 in Portland

- April 8-9 in Portland

- May 13-14 in Pasco, Washington

- June 10-11 in Missoula, Montana

- July 15-16 in Portland

- August 12-13 in Portland

- September 9-10 in Eugene, Oregon

- October 15-16 at the Tamarack Resort, Idaho

- November 18-19 in Portland

- December 16-17 via webinar

Meeting dates and times for 2026 will be announced later this year.