Background

The Northwest is unique in how it plans its energy future. Through the Northwest Power and Conservation Council's power plan (see draft plan and appendices), strategies to ensure the affordability and adequacy of the power system are developed in an open forum where the public can voice its opinion. Why is this so important? With the building of the region's first mainstem Columbia River dams in the 1930s, the Northwest would have access to inexpensive electricity for many years. But by the 1960s, increased demand led energy planners to believe that hydro-generating resources would soon be unable to keep up with the demand for electricity.

In the 1970s, the Bonneville Power Administration-the federal agency that markets the electricity generated at federal dams on the Columbia River-began working with public and private utilities in the region to develop major new generating resources, including several nuclear plants. But the projects proved to be hugely expensive and electricity rates, as a consequence, skyrocketed. Growth in electricity demand fell far short of earlier projections, in part because of the high rates. The region was left with an energy surplus in the early 1980s, eliminating the need for most of these new and expensive generating plants. Many of the projects were abandoned, and the region was left with the then-largest municipal bond default in U.S. history. Northwest customers continue to make payments on part of this debt.

Amidst the turmoil caused by this massive planning failure, Congress enacted the 1980 Pacific Northwest Electric Power Planning and Conservation Act authorizing the states of Idaho, Montana, Oregon, and Washington to form the Council, an interstate agency. The Act requires the Council to develop a 20-year power plan to assure the region of an adequate, efficient, economical, and reliable power system; and to develop a fish and wildlife program to protect, mitigate, and enhance fish and wildlife affected by the dams. The Act also requires the Council's power plan to give first priority to cost-effective conservation; second to renewable resources; third to generating resources utilizing waste heat or generating resources of high fuel conversion efficiency; and fourth to all other resources. The power plan is updated every five years.

The experience of the 2000-2001 West Coast electricity crisis, when the wholesale power market exhibited extreme volatility and price spikes, only reinforces the importance of the Council's role. The Council doesn't set rates; it doesn't finance or build power projects. Its power plan lays the framework for the region's energy future. The question the power plan tries to answer is: What should be doing now to prepare for the future?

Recommendation: Conservation

With respect to resource choices, the Council recommends that the region increase its efforts to secure cost-effective conservation immediately. The Council considers improved energy efficiency to be a resource for meeting future electricity demand. Although conservation may result in small rate increases in the short-term, it can reduce both cost and risk in the long-term.

The power plan calls for aggressive and sustained development of conservation: 700 average megawatts between 2005 and 2009.

Recommendation: Demand response

The Council also recommends developing demand response programs-agreements between utilities and customers to reduce demand for power during periods of high prices and short supply. The Council recommends developing 500 megawatts of demand response between 2005 and 2009. Demand response has proven helpful in stabilizing electricity prices and in preventing outages. The Council's analysis shows that although it will probably be used infrequently, demand response reduces both cost and risk compared to developing additional generation.

Recommendation: Wind

Wind generation figures prominently as a resource in the next decade. The attractiveness of wind depends on a number of estimates: that wind incentives will continue unless carbon dioxide emissions controls are enacted; that the trend of decreasing costs will continue over time; that the cost of integrating wind energy into the power system will remain relatively low; that development of large areas of good wind resources west of the Rocky Mountains region will be possible; and the likelihood that some form of increased restrictions on CO2 emissions will be imposed in the future.

Over the next five years, the power plan calls for gathering more experience and information about wind resources and their performance and cost within the regional power system. The Council recommends developing wind generation at a moderate commercial scale-between 50 to 100 megawatts per year-at geographically diverse wind resource areas to resolve the uncertainties associated with this resource and to prepare for its eventual large-scale development. The level of near-term development is consistent with the wind development identified in the resource plans of regional utilities.

Recommendation: Prepare for new power plants

Although the region as a whole currently enjoys a surplus of generating capacity due to reduced demand and the construction of new generating plants over the past three years, the region should secure sites and permits to be prepared to begin construction of new coal generating resources as early as 2010, and to construct additional wind generation shortly thereafter. Later in the 20-year planning period, some additional gas-fired generation may be needed.

Transmission upgrades should be identified so all these resources can be built and brought on line quickly when required. If major transmission upgrades are needed, that work will have to begin before construction of the power plants.

Key policy issues

Along with the Council's recommended resource development plan'the least risk development plan according to the Council's analysis?the power plan includes recommendations on key policy issues confronting the region. These include transmission operation and planning issues, the establishment of resource adequacy standards, and the future role of the Bonneville Power Administration in power supply.

With respect to Bonneville's role, the Council recommends that the agency sell the electricity from the existing Federal Columbia River Power System to eligible customers at cost. Customers that request more power than Bonneville can provide from the existing system should be required to pay the additional cost of providing that service. The Council recommends that Bonneville implement this change through new long-term contracts to be offered in 2007.

Regarding the other issues, the power plan supports the collaborative processes in the region currently underway to address these problems.

Recommended action items for next five years

1) Develop resources now that can reduce cost and risk to the region

- 700 average megawatts of conservation, 2005 - 2009

- 500 megawatts of demand response, 2005 - 2009

- Secure cost-effective cogeneration and renewable energy projects

- Develop cost-effective generating resources when needed

2) Prepare to construct additional resources

- Maintain an inventory of ready-to-construct projects

- Resolve uncertainties associated with large-scale wind development

- Encourage use of state-of-the-art generating technology when siting and permitting projects

- Plan for needed transmission

- Improve utilization of available transmission capacity

3) Confirm the availability and cost of additional resources that promise cost and risk mitigation benefits

- Oil sands cogeneration

- Coal gasification

- Carbon sequestration

- Energy storage technologies

- Demonstration of renewable and high efficiency generation with Northwest potential

4) Establish the policy framework to ensure the ability to develop needed resources

- Carry out a process to establish voluntary adequacy targets for the Northwest and the rest of the Western system

- Work through the Grid West, Regional Representatives Group process to address emerging transmission issues within the next two years

- Revise the role of the Bonneville Power Administration in power supply, consistent with the Council's May 2004 recommendations

5) Monitor key indicators that could signal changes in plans

- Periodically report on the regional load-resource situation and indicate whether there is a need to accelerate or slow resource development activities

- Monitor conservation development and be prepared to intensify efforts or develop alternative resources, if necessary

- Monitor efforts to resolve uncertainties regarding the cost and availability of wind generation, and prepare to develop alternatives, if necessary

- Monitor climate change science and policy for developments that would affect resource choices

Graphs and tables

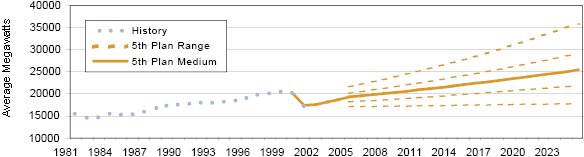

Range forecast of electricity demand

This graph shows the range of forecasts compared to historical consumption. Electricity demand dropped by 2,800 average megawatts between 2000 and 2002 because of electricity price increases and the economic slowdown.

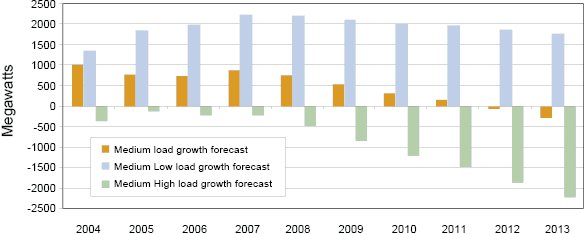

Annual average load/resource balance (under driest conditions)

Since 2000, over 4,500 megawatts of generating capacity has been built in the Northwest. This, combined with the loss of load shown in the demand forecast graph, has led to a surplus of generation. The bars in this graph show the amount of generation in excess of load for three demand forecasts. The graph indicates that under the most likely range of load growth, new generating resources are unlikely to be needed until the end of the decade.

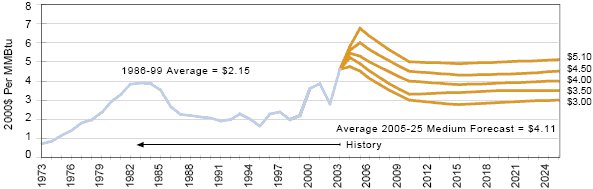

Historical and forecast natural gas prices

Natural gas prices have risen significantly and are expected to remain at high levels in the future.

Resource supply forecast (beginning with least cost)

| | Levelized costs

in cents per

kilowatt hour | Energy in

average megawatts | |

| 1 | Commercial New & Replacement Lighting | 1.22 | 245 | |

| 2 | Commercial New & Replacement Infrastructure | 1.42 | 11 | |

| 3 | New & Replacement AC/DC Power Converters | 1.49 | 156 | |

| 4 | Residential Dishwashers | 1.6 | 10 | |

| 5 | Agriculture ? Irrigation | 1.6 | 80 | |

| 6 | Commercial New & Replacement Shell | 1.62 | 13 | |

| 7 | Industrial Non-Aluminum | 1.7 | 350 | |

| 8 | Residential Compact Fluorescent Lights | 1.7 | 535 | |

| 9 | Commercial Retrofit Lighting | 1.84 | 114 | |

| 10 | Residential Refrigerators | 2.1 | 5 | |

| 11 | Residential Water Heaters | 2.2 | 80 | |

| 12 | Commercial Retrofit Infrastructure | 2.2 | 105 | |

| 13 | Commercial New & Replacement Equipment | 2.22 | 84 | |

| 14 | Chemical Recovery Boiler Upgrades (incremental cost) | 2.34 | 280 | |

| 15 | Residential New Space Conditioning? Shell | 2.5 | 40 | |

| 16 | Central MT Wind for local load, firmed and shaped | 2.59 | 100 | (typical project) |

| 17 | Residential Existing Space Conditioning ? Shell | 2.6 | 95 | |

| 18 | Commercial Retrofit Shell | 2.87 | 9 | |

| 19 | Residential HVAC System Efficiency Upgrades | 2.9 | 65 | |

| 20 | Commercial New & Replacement HVAC | 3.03 | 148 | |

| 21 | Residential HVAC System Commissioning | 3.1 | 20 | |

| 22 | Eastern WA/OR Wind | 3.23 | 100 | (typical project) |

| 23 | Commercial Retrofit HVAC | 3.29 | 117 | |

| 24 | Commercial Retrofit Equipment | 3.45 | 109 | |

| 25 | Landfill Gas Energy Recovery | 3.75 | 150 | |

| 26 | Montana pulverized coal for local load | 3.81 | 400 | (typical project) |

| 27 | Goldendale CCCT (Cost to complete) | 4.17 | 248 | |

| 28 | Eastern WA/OR Integrated coal gasification w/o carbon dioxide separation | 4.29 | 425 | (typical project) |

| 29 | Residential HVAC System Conversions | 4.3 | 70 | |

| 30 | Residential Heat Pump Water Heaters | 4.3 | 195 | |

| 31 | Eastern WA/OR Pulverized Coal or MT Coal w/ TX to Mid-C at embedded cost | 4.31 | 400 | (typical project) |

| 32 | Grays Harbor CCCT (Cost to complete) | 4.31 | 640 | |

| 33 | Montana First Megawatts (Cost to complete) | 4.39 | 240 | |

| 34 | Residential Hot Water Heat Recovery | 4.4 | 25 | |

| 35 | Mint Farm CCCT (Cost to complete) | 4.55 | 286 | |

| 36 | Eastern WA/OR CCCT | 4.71 | 610 | |

| 37 | Animal Manure Energy Recovery | 4.83 | 50 | |

| 38 | Residential Clothes Washers | 5.2 | 135 | |

| 39 | Wood Residue Energy Recovery (non-cogen) | 5.54 | 25 | |

| 40 | MT Coal Steam w/ TX to MidC at cost of expansion | 6.04 | 1000 | each sized to capacity

of 500 KV

transmission expansion |

| 41 | Central MT Wind w/ TX to MidC, firmed and shaped | 6.08 | 1000 |

| 42 | MT Integrated coal gasification w/ TX to MidC and carbon dioxide separation | 6.9 | 1000 |