Council releases initial 20-year forecast for Pacific Northwest electricity demand

Council urges public to exercise caution in interpreting analysis, because it shows higher peaks and annual energy than will actually occur

- May 02, 2025

- Peter Jensen

On April 29, the Power Division staff released a new initial forecast showing a range of potential electricity demand growth in the Pacific Northwest over the next two decades. Senior Energy Forecasting Analyst Steve Simmons, Senior Power Analyst Tomás Morrissey, and Power System Analyst Jake Kennedy led a presentation on the forecast during an online meeting of the Council.

The Pacific Northwest – which the Council defines as Oregon, Idaho, Washington, and Western Montana – has consumed approximately 22,000 aMW (average megawatts) of electricity per year for the last several years. The forecast projects annual energy demand growth to reach between 31,000-44,000 aMW by 2046, varying by trajectory. In February 2025, the Northwest electricity grid hit a winter peak of approximately 35,500 MW, which was an increase over the previous winter peak of 35,100 MW in 2023. During a heatwave in July 2024, the region reached a summer peak of 33,300 MW. By 2046, the forecast trajectories project peak demands ranging between 47,000-60,000 MW.

The average growth rate per year for annual energy ranges between 1.8% - 3.1% from 2027-2046; it ranges between 1.9% - 3% for peak demand over that period of time. Read the full analysis here. Watch video from staff’s presentation here.

Upcoming demand side resource analysis

The Council urged the public to exercise caution in interpreting this analysis, because it shows higher levels of electricity consumption in peak demand and in annual energy than will actually occur. This is because this load forecast intentionally doesn’t account for the cost-effective energy efficiency, demand response, and rooftop solar that will be identified through the plan analysis and be included in the resource strategy for the Council’s next power plan, called the Ninth Power Plan. These resources flatten peaks and reduce electricity demand.

For example, unmanaged electric-vehicle charging that often occurs in after-work hours can coincide with other peak hour power needs. Demand response programs could manage the charging in several different ways that have less impact on power system peaks – such as after midnight. The initial load forecast assumes unmanaged charging, leaving the demand response potential of managed charging as an option for Power Division staff’s computer models to choose when they analyze different resource strategies for building out the Northwest electricity grid in the future.

At the Council’s meetings in May and June, staff will be presenting potential for energy efficiency and demand response resources. The Council will take this potential, analyze how much is cost-effective, and then decide how much should be included in the Ninth Power Plan. Staff presented the rooftop solar potential for residential and commercial buildings in April. Their analysis found cumulative rooftop solar potential will surpass 500 aMW in 2031 and grow to above 4,000 aMW by 2046.

Once the Council decides how much energy efficiency, rooftop solar, and demand response is cost-effective, staff will re-run the load forecast to get the final version to include in the Ninth Plan. The Ninth Power Plan will assure the region of Washington, Montana, Idaho, and Oregon of an adequate, efficient, economical, and reliable power supply. The plan's cost-effective resource strategy will ensure the power system’s adequacy and reliability risks remain within established thresholds.

The Council will develop this plan through extensive public process and regional engagement over the next two years. Council staff intend to have a draft power plan ready for public review and comment by July 2026, with a final version adopted by the end of that year.

“Heatwaves and winter storms have stressed our power system in recent years,” said Montana Council Member Doug Grob. “Every resident and business owner in the Northwest must be assured that their power supply will be there when it’s needed most – from our major urban centers out to the rural homeowners, small businesses, farmers, and ranchers who live at the ends of the power lines. Planning for an adequate and reliable power supply is our legal duty under the Northwest Power Act. The Council will ensure this is achieved in the Ninth Power Plan.”

“The next two years are a critical juncture for planning our energy future in the Pacific Northwest,” said Washington Council Member K.C. Golden. “The Northwest Power Act gives everyone a seat at the table as the region navigates critical decisions that will shape our economy and environment going forward. The stakes are high and the challenges are real. We invite Northwest residents to join us and weigh in as we develop our next plan.”

Planning for a range of energy needs and uncertainty, as well as protecting fish and wildlife in the Columbia Basin

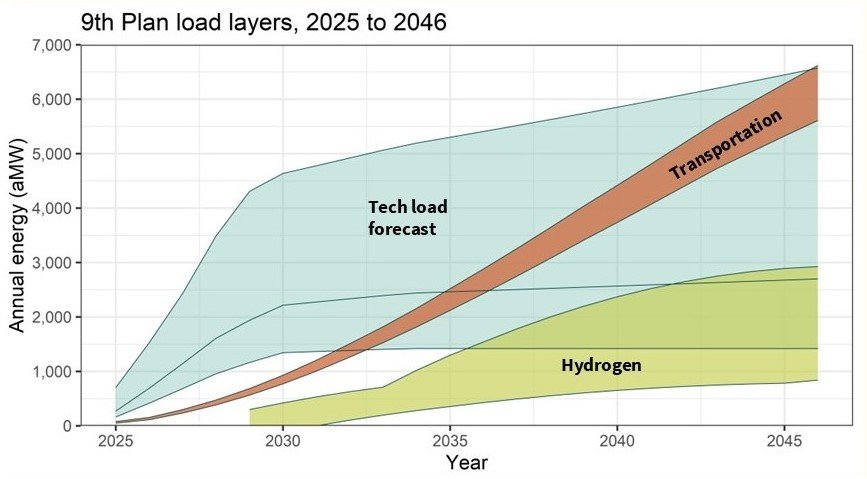

The demand forecast analysis captures a range of possible trajectories across sectors of electricity demand in the Pacific Northwest. The largest sources of future demand growth will be residential and commercial buildings, data centers and chip fabrication facilities, electric vehicles, and hydrogen production. The Council’s forecast covers high, medium, or low forecasts for each of these sectors, resulting in different pathways for how electricity demand could materialize in the Northwest over the next 20 years.

This is the most complex, data-intensive, and sophisticated load forecast the Council has ever produced. Power system analysts used upgraded computer modeling to produce annual, monthly, and hourly forecasts of load between 2025-2046 for the Northwest as well as for 13 individual utilities’ balancing authorities in the region. They also included data from 27 weather stations in Oregon, Washington, Idaho, and Montana, which allowed staff to forecast future changes related to weather and climate conditions and how that could affect electricity demand. Over the past several months, staff checked assumptions and analysis with the Council’s Demand Forecast Advisory Committee consisting of regional utilities, regulators, major industries, technical experts, and public interest groups.

“Since 1980, the Council’s power plans have helped keep costs affordable for residents, businesses, and industries,” said Idaho Council Member Jeff Allen. “Our upcoming regional power plan will look to build on this legacy and create a blueprint for the cost-effective expansion of our power grid. This will provide certainty to businesses and industries looking to locate or expand in the Northwest, as well as grow our economy and well-paying jobs for the next generation.”

Based on historical trends and announced projects, the Council expects data center and chip fabrication developments to mostly (but not exclusively) occur in Eastern Oregon, Eastern Washington, the Portland metro area, and the Boise metro area. To create the Ninth Plan tech load forecast, staff used historical industrial or commercial sales trends through 2023 (via EIA form 861); utility data center growth projections (from integrated resource plans); project announcements; discussions with utilities; and analyst insights. Technology sector load growth in the region could be constrained due to infrastructure needs, construction timelines, permitting, supporting power infrastructure and supply, and other factors. Council staff have developed three tech forecasts, low, medium, and high, to help account for this uncertainty.

Electricity grids in the Northwest and across the U.S. are encountering significant challenges with transmission system constraints, supply chain delays and issues, and interconnection queue backlogs. The Council uses scenario modeling to explore how changes in key assumptions impact the modeled resource build for the Northwest. The Council is planning a scenario to explore uncertainty in the cost and availability of new resources and transmission to specifically address this uncertainty. Much of the scenario modeling will take place between fall of 2025 and spring of 2026. Read more here for details on scope of the resource and transmission risk scenario.

A hallmark of the Council’s planning over the past 45 years has been the explicit recognition that the future cannot be predicted precisely, and that uncertainty and inexactitude are facts of life in power planning. Over that time, however, the Council’s power plans have helped the Northwest’s electricity grid navigate numerous upheavals, transformations, challenges, and points of uncertainty.

This includes periods of strong economic growth as well as deep recession, severe droughts and extreme weather, major influxes in population growth and development in the region, and new manufacturers and industries taking root and expanding, while others – such as aluminum smelters – have left the region completely. The regional power system has experienced the emergence of wholesale power markets in Western North America, a shift in the resource mix as existing units have retired and been replaced, decarbonization policies, and much more. The Council’s planning under the Northwest Power Act will help the electricity grid undergo and successfully navigate more changes over the next two decades.

The Power Act also directs the Council to a second critical mission – protecting, mitigating, and enhancing fish and wildlife impacted by the Columbia River hydropower system. The Council will be working with the public and the region to update its Columbia River Basin Fish and Wildlife Program in 2025 & the early months of 2026.

“Our new demand forecast helps us understand the potential growing and evolving energy needs of the communities, businesses, and industries in our region,” said Oregon Council Member Margi Hoffmann. “The Council will develop a plan for meeting all these needs over the next 20 years, while also protecting and mitigating for fish and wildlife in the Columbia River Basin through our next Fish and Wildlife Program. Throughout 2025 and 2026, we will be addressing the growing need for energy along with the urgent need to protect fish and wildlife in our Basin.”